A Guide to Family Business Decision Making

The topic of group decision making has spawned many academic studies, books, and white papers. It is never easy to get a group of human beings to make a decision together; it’s hard enough for a single individual to make a decision! Add to the mix more people with their cultural differences, values, needs, desires, positioning, and familial relationships and you have got a natural recipe for deadlock. We are often asked what the best way is for families to make important decisions together.

To answer this, let’s consider some of the overarching goals and pitfalls to avoid when making any major decisions together:

Goals

- Preserve Familial Relationships

- Build Cohesion

- Have Freedom from political warfare

- Avoid outside intervention in decision making

Avoid

- Conflicts and tensions/destruction of family

- Legal challenges/frustrated family members

- Marriage Conflict

- Feeling marginalized with “nothing to lose” thinking

- Battles and defections

Successful Models

Academia has given us a multitude of models for decision making in organizations and families. Here are six decision making styles frequently used in family businesses.

- The family leader decides unilaterally and announces the decision to everyone else.

- The decision is almost made, but the leader seeks reactions from others before announcing the final decision.

- The leader solicits input from everyone else before deciding.

- Majority vote with leader having one vote and no veto power.

- Everyone reaches agreement after discussion.

- The decision making is delegated to someone with clear parameters of freedom.

Most people, when asked, will say that majority rule is the most fair and proper way to make decisions. Americans naturally believe that our democracy is superior to any other political system ever devised so why not use it in our family? Yet, consider how you would feel after a presidential election in which your candidate lost. You are likely to experience a range of emotions ranging from mildly annoyed to furious.

Now, imagine being in the minority in a family or family business decision that affects you on a deeply personal level. What if a decision you strongly disagreed with was forced on you against your will? How well would that work in a family setting? Are you starting to see the problem with autocratic and majority decision making styles? Some people or groups of people are inevitably going to be disappointed.

What?!

Experience has shown that the best way to make decisions in families is to choose Style #5: Consensus. “What?!” you might be thinking. “How can anyone get anything done? I could never get my family to agree on what to have for dinner, let alone the direction of our business.” Without a doubt, building consensus in a family takes a lot of time, and energy, and requires patience and good communication skills, but it’s very much worth the effort!

Consensus is the only one of the five decision making styles that simultaneously builds unity, maintains unity, requires unity, and creates a family of listeners and collaborators.

Nordstrom is a well-known family business which has achieved tremendous success through the use of a consensus style of decision making. For the last 69 years they have had co-presidents, a leadership method that requires unanimous decisions in order to move forward. Given Nordstrom’s history of success and strong brand, that’s quite a recommendation for the consensus style, don’t you think?

WHO SHOULD GET A VOICE IN FAMILY DECISION MAKING?

Here are some recommended qualifications to consider when deciding if a family member is ready to be included in major family business decisions:

• Are they emotionally mature?

• Do they contribute to the process?

• Are they flexible?

• Are they informed?

• Are they prepared?

• Are they trusting and trustworthy?

• Are they able to put needs of the group ahead of needs of self?

Conclusion

As you can see, armed with the right tools and the right attitude, family decision making does not need to be contentious. To the contrary, it can have a tremendous unifying effect on your family while it facilitates decisions that increase the long-term success of the family and its enterprises.

We hope you found this article about Decision Making in Your Family Business helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or home page www.Groco.com. Unfortunately, we no longer give advice to other tax professionals gratis.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

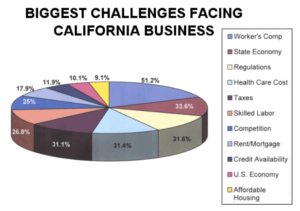

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…