Defining the First Six Stages of a Business in the Venture Capital World

Defining the First Six Stages of a Business in the Venture Capital World

Stage 1

Enterprise has no product revenue to date and limited expense history, and typically an incomplete management team with an idea, plan, and possibly some initial product development. Typically, seed capital or first-round financing is provided during this stage by friends and family, angels, or venture capital firms focusing on early-stage enterprises, and the securities issues to those investors are occasionally in the form of common stock but are more common in the form of preferred stock.

Stage 2

Enterprise has no product revenue but substantive expense history, as product development is under way and business challenges are thought to be understood. Typically, a second or third round of financing occurs during this stage. Typical investors are venture capital firms, which may provide additional mangement or board of directors expertise. The typical securities issued to those investors are in the form of preferred stock.

Stage 3

Enterprise has made significant progress in product development; key development milestones have been met (for example, hiring of a management team); and development is near completion (for example, alpha and beta testing), but generally there is no product revenue. Typically, later rounds of financing occur during this stage. Typical investors are venture capital firms and strategic business partners. The typical securities issued to those investors are in the form of preferred stock.

Stage 4

Enterprise has met additional key development milestones (for example, first customer orders, first revenue shipments) and has some product revenue, but is still operating at a loss. Typically, mezzanine rounds of financing occur during this stage. Also, it is frequently in this stage that discussions would start with investment banks for an IPO.

Stage 5

Enterprise has product revenue and has recently achieved breakthrough measures of financial success such as operating profitability or breakeven or positive cash flows. A liquidity event of some sort, such as an IPO or a sale of the enterprise, could occur in this stage. The form of securities issued is typically all common stock, with any outstanding preferred converting to common upon an IPO (and perhaps also upon other liquidity events).

Stage 6

Enterprise has an established financial history of profitable operations or generation of positive cash flows. An IPO could also occur during this stage.

We hope you found this article about “Defining the First Six Stages of a Business in the Venture Capital World” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

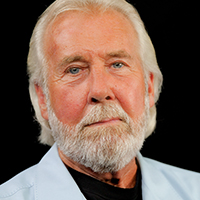

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…

Early Detection Saves Lives with Steve Marler

Steve Marler, Founder of Advanced Longevity discusses how early detection can save lives and overcoming a broken healthcare system on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to American Dreams. My guest today is Steve Marler. Steve, welcome to the show. Steve Marler Thank you. It’s great to be here. Alan Olsen So Steve,…

Preserving My Family’s Life’s Work & Legacy

Tom Chatham, Chairman of Chatham Created Gems & Diamonds, Inc., discusses preserving his family’s legacy and life’s work on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to America dreams. My guest today is Tom Chatham. Welcome to today’s show. Tom Chatham Thank you glad to be here. Alan Olsen So, Tom, we’ve had…