Common Trust Fund Questions for Beginners

Are you considering a trust fund? Trust funds are a very useful tool for saving and investing money, but a lot of people aren’t totally sure how to use a trust or even how they work. Trust funds essentially hold assets, like property, a business or money, for the benefit of another person, a group of people or even an organization. There are several common questions regarding trusts, so let’s take a look at some of them.

- How are trust funds structured – a trust fund is a specially created entity that is held in the state where it was formed. In some states you can create perpetual trust funds, which never end, while other states only allow trusts with a termination date.

- What are the reasons to use a trust fund – there are many reasons to set up a trust, but one of the best reasons is that they can protect your assets from creditors. Another reason to use a trust is to protect your assets from untrustworthy family members. You can use a trust to save thousands or even millions of dollars from taxes by donating the trust assets to a charity.

- When is the right time to form a trust – this is a wide-open question because every situation is unique. It depends on your reason for setting up the trust, how much you will be putting into the trust and who will be the beneficiary. It’s best to speak with a professional to determine when the right time is for you.

If you think you are ready to create a trust then come talk with us at GROCO for more ideas and information. One of the biggest factors to consider is how your trust will affect your taxes. We will help you look at all your options and make sure that your trust is set up to be as tax-friendly as possible. Just give us a call at 1-877-CPA-2006, or click here to learn more.

Finding Networking Opportunities Is Easy!

Finding Networking Opportunities Is Easy! By Leni Chauvin Business networking is all about forming strong relationships built on mutual respect and trust. Those relationships are the basis for the single most important tool that we all need if we want to survive in the competitive 21st century. I’m talking about referrals. And today’s savvy business…

5 Marketing Moves for Business Success

5 Marketing Moves for Business Success By David Newman Effective marketing can be simplified into five moves – five concrete actions – that you can implement immediately. Your challenge: try one or more of these NOW. Marketing has traditionally been broken down to a formula known as “the 5P’s” – the five factors that make…

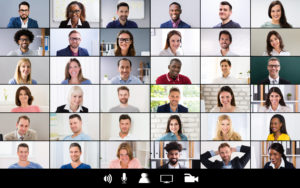

Video Conferencing – It Finally Works

Video Conferencing – It Finally Works By Harold German Remember those bulky, expensive video conferencing systems you would see in well-equipped conference rooms not too long ago? You know, the ones the office manager never allowed you to touch? Every now and then, you were invited to sit in on a video meeting and you…

Technology & Business Expansion: Matching Your Data Systems to the Business Growth

Technology & Business Expansion: Matching Your Data Systems to the Business Growth By Dan Kaplan Fueling the high growth rate for Retailers, Manufacturers and Distributors is a flurry of mergers and acquisitions. In today’s world of mergers and acquisitions, and heavy usage of the Web, companies are facing a new reality. Software that meets the…