Consider Taxes and Choose Your Retirement Location Carefully

Last week we discussed the best and worst states to retire in when it comes to taxes. So what kinds of factors actually play a role in coming up with those numbers? Choosing a place to call home when you retire is important and there are many factors that can play a role in where you end up. However, speaking strictly in regards to taxes, these are the top four taxes to consider when you’re ready to hang it up and retire.

Of course, your federal income tax will be the same wherever you end up so that is not relevant, but these four other taxes are:

- State income tax – most states charge income tax, but the rates vary. There are seven states, however, that don’t charge any state income tax, which could greatly reduce your retirement taxes.

- Social Security tax – the next tax to look at is the SS tax. There are 13 states that will tax your Social Security benefits; so avoiding these states will reduce your tax bill.

- Sales tax – all but five states have a sales tax but every state’s sales tax rate will differ, so that is another important tax to keep in mind when you retire.

- Property tax – your property tax will also affect your total tax bill so keep this tax in mind when choosing your final home destination, as well.

The bottom line is you should enjoy retirement, no matter where you live. So make sure you choose your location wisely and consider all of these different taxes and how each will affect your personal situation before you make your choice.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

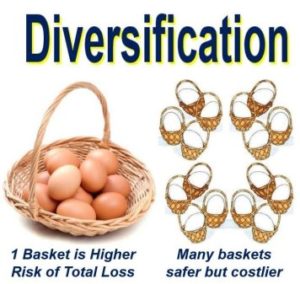

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

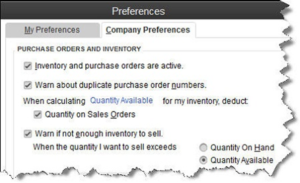

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…