Episode 21: IRS Budget On Steroids!

In this episode we cover The New Retirement Bill, the Higher IRS Budget Proposal, the attempt to take away the “John Edwards” rule for S Corporations and other entities, Truckers and AB5.

Tax Update with Ron · Episode 21 The IRS is Getting a Funding Increase

Transcript:

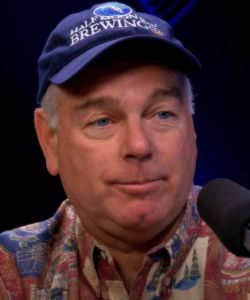

Hello and welcome. This is Ron Cohen with the CPA firm of Greenstein Rogoff Olsen & company. And this is the tax update for July 11th, 2022. And those dates are important, because everything is so fast changing. I’m a tax partner. Here and today we’re going to cover a new retirement bill that’s got through the Senate finance committee.

The fact that they’ve passed in Congress, hired budgets for the IRS, a proposal that’s in a current bill to get rid of S Corp and passed through the exemptions to Medicare taxes. Some social security taxes and we’ll finish off with some discussion about California, independent contractor rules under AB five and a Supreme court case about that about it that affects truckers.

So just a few caveats before we start, take no reliance on anything you hear in this podcast before you file any tax turns or execute any transactions related to taxes, you need to get professional assistance. We’re happy to help, but you have to come in and. Now due to COVID write everything’s remote for the most part, but present all the facts and so forth.

We go through, come up with a professional opinion and then you can rely on that, but not on this podcast. Here plagiarism is okay. We’re not writing any novels. Everything in the tax law is somebody’s copying somebody else. And when I’m not professing for one moment to try to. To say that this is original work of any sort.

So we try to avoid politics as much as possible. You can listen to podcasts all day and night regarding national or state politics, even some local politics. But there are circumstances since all tax law. Is evolves through politics where I’ll have to mention some political aspects to tax law, but we try to keep it out of the endless political battles that are going on in this country.

Okay. Our, our firm does about 1400 tax returns. We do planning for all kinds of people. Our office specializes in family office services for big wealthy families who need those kinds of. That kind of a hands on assistance. And then lastly, just want to say, I’m no cheerleader, I’m no cheerleader for the tax system.

I think it’s a it’s an invasion of privacy. I think it’s a it’s intrusive it’s tedious. But every tax return we do, we try to get an, a plus, no, a minuses, no BS. We follow the law. We try to do the right thing.

I’ll start back here. We’re no cheerleaders for the tax law. We always try to get an a plus we’re compliant. We follow the law. We get a pluses on returns, not a minuses, not BS, not CS, but the tax law is often invasion of privacy. It’s tedious, it’s way too complicated. And but we do the best we can.

And we help clients through. It. Okay. Our website it’s www.GROCO, G R O C O.com. Our phone number’s five ten seven nine seven eight six six one here again in Fremont, California. So let’s get into it, starting with the first bit, is that. The Senate finance committee has passed with a 28 to zero vote.

So that means they really liked it. On June 22nd, they approved a bipartisan retirement security legislation aimed at making it easier for businesses to offer tax qualified retirement savings plans to their employees and for individuals to participate in retirement plans and grow. Preferred savings. So I’ll, I’ll make a comment or two.

This is a long. Historical journey where they tried to simplify retirement plans so that any business can quickly go and sign up for some kind of profit sharing plan or, or define benefit plan defined contribution plans. The defined benefit plans are really complicated and, and. Small businesses can’t afford the time or money or find the expertise to run them.

So they try to make it as easy as possible for companies and their employees and individuals to have these plans where you put the money in sometimes you get a deduction for the money you’re contributing. And then the money can accumulate tax free over a number of years. Then when you’re in retirement or over age, 59 and a half you can.

Taking money out of the retirement plan. The whole game is the thought is that at some, some point in the future, you may be in a lower tax rate than you are now when you’re working. But that is that’s a bit of controversy there because we’re worried about what’s happening. Some of the financial planners are saying, no, you’re going to be in a higher tax bracket.

Later on. So maybe you’d be better off just paying taxes now and having the after tax money. Anyway, that’s a whole hour discussion on its own, but they’re, they’re trying to make it so more people can participate in retirement plans, make it easier for businesses to have the retirement plans without going through a determination letter, to set up a plan and have to hire an actuary and get.

Trustee and on and on and on and make people be able to put away as much as they can. So this new bill that is past the Senate finance called their earn act has allows participants nearing retirement to contribute more, their more to their retirement accounts we’ve had for years where the for IRAs the amount you could contribute was higher.

If you were older, They want to expand that a lot of people are saying, gee, I’m getting old. I’m not going to work forever. I want to put as much disposable income as possible into these plans. So they’re trying to make that as possible as it can be modify certain retirement plan design rules. Yes, please.

These design rules are way too complicated, so that’s, that’s a good shade remove barriers. To offering certain types of annuity products within the fine contribution plans. Now I have a, I’m a two minds of that. Annuity plans are thro are, are, are fraught with long history of problems high. Charges for cashing out your annuity too soon.

Some of that was fixed. Annuities can be complicated. So there was good reason that annuities were kept out of some of these retirement plans because people felt they were getting ripped off in them. So good. Well, they’re going to let you have that as one of the choices, but be careful, be careful.

Okay. And offset the bulk of their proposed. Retirement security enhancements through Roth IRA. So what they’re talking about there is that in the, in the individual retirement account world the whole game either after the fact or the initial year or during the initial year is to get money into one of these Roth plans where if you leave it in there five years, when it comes out, it’s all tax free.

If you put money into a retirement plan, Or a traditional Roth, when you take the money out, you have to pay. Income tax on the earnings of the plan. It gets really complicated. I won’t go through all the allocation rules and so forth. So the hope is, oh, well, let’s make it. So the more and more people can be into plans that are quasi Roth plans.

And as long as you leave the money in there long enough, boom, you’re done. There is no future tax. And then again, that, that gets away from the issue. Of well, is my tax rate higher now? Or will it be lower when I retire? If it’s a Roth and you meet the timing rules tax rates are irrelevant because with a Roth, there is no tax on distributions.

If you meet the age and holding period requirements. So they’re trying to, and I’ll be quite blank. Frank, a lot of this is because people don’t trust the government. They think as the government becomes more and more indebted at some point they’ll attack social security and they’ll attack distributions from retirement plans.

So they’re passing rules now to make it better. I, I sure hope. Pans out over the next 10, 15 years, because social security and Medicare are, are thought to be in some trouble in terms of financing and the only big pool of money out there is Is in all these retirement plans. For me, for one again, trying not to get too political set the rules, make them simple, make them easy, make them as positive as possible for taxpayers and just leave them alone.

But here, here, they’re making some changes trying to make retirement area. A little better. Okay. So moving on from that again, you can look at, we’ll put some links in the show notes. You can look at the earn act and see all the modifications that are being made, hopefully to make retirement planning a little easier and better and allow.

For more contributions, the internal revenue service looks like it’s going to get more money. This is back on June 24th, the house appropriations committee approved that the IRS is going to get about a billion dollars more for 20, 22. Now that, that the final passage came with a vote of. 31 to 22 that’s in the house appropriations committee.

Now know the way our system. Everything related to taxes has to pass the house appropriation committee. Then it goes to the full house, which is 435 Congress people. And they do their thing. If it passes there, it goes to the Senate. And we’re pretty much in a, a split, depending on people vote in the Senate.

But, but on a lot of things that everyone agrees on a lot of Republicans come over and vote with the Democrats and there’s no issue in the Senate about a 50 50 split. And that happens quite often. And then it goes to the president and he signs it if he likes it or he can veto it.

Okay. Enough for the civics class here, the upshot is that the IRS is getting about a 10. Percent increase maybe a little bit more in its budget. And that is because of, as the secretary of treasury said last month in a hearing with the house of representatives said that the IRS staffing level is at the level.

It was 40 years ago. Now and more, and with regard to their computer system, they’re using some old ancient Cobal. From what I know, software program secretary treasury, Janet Yellen was complaining that there is no university in the United States that teaches that software language. Yet the IRS, which is really the largest financial institution on the planet, something like four and a half trillion dollars cycle through the us treasury and the IRS every year.

So without question, it’s the largest financial institution on the planet and it’s UGI using ancient stuff for software. So it’s a miracle it’s able to do what it does and it gets it done. So there’s been outcry forever for more money. Getting a little political here. There’s always the both parties tend to want the IRS not to audit too much.

That’s both Republicans, Democrats, and everyone else. There’s been some situations where the IRS has gotten overbearing. I will say that, when I started in the late 1970s, either you were being audited or you knew of a friend that were, was being audited by the IRS, every. There people were constantly being audited.

Now this was all before, computers and laptops. There were big computers, but nothing like what we have today on our cell phones and our laptops and our desktops. So what they’ve done though, is that the tax turns are so automated and they’re eFiled. So many things there. There’s not as much to play with or to make mistakes on.

And when I say play, I, I mean in a legal way, in an ethical way. So the audit rate is way, way, way, way, way down. And that’s because they’ve structured the forms and they’ve made me as the preparer, the one who has to audit you first, basically by doing the tax return in a very ethical way following all of our checklists and then it goes in and then you Yeah.

You know, the computer system before the e-filed return can even be accepted into the IRS, has to go through. I know our software says it does like 3000 continuity checks following the rules. If there’s a number on page 18, it ought reconcile to the number on page two for the same sort of thing. And GE does do these numbers look unusual in, in their relationship.

We get these things called diagnostics. So what’s happened over the last 20 years is the first audit function basically is your prepare. And we absolutely under IRS rules circular two 30. Are required and authorized to ask a lot of questions and while we’re your best friend and we want to help you do the tax turn to get the lowest legal tax.

We’re supposed to ask a lot of questions and use some skepticism. When you give us something say, well, that doesn’t look right to me. Please explain why, why this is happening and why this document says this number. For example. I’m rambling on a bit, but for example, if you make $40,000 a year and you’re deducting $30,000 in charitable contributions, that could be true.

Maybe you have a ton of pent-up savings and so forth, but for most people it’s not true. Right. And we’re supposed to see those relationships. And so the first auditor. Is your tax term preparers saying, well, explain to me why this makes some sense. And the IRS has certainly done that. That’s why there are much less audits than there were before, but they’re upping the budget.

Because also a well published number was that the IRS is currently returning nine or answering, not returning, forget returning, they’re answering 9% of the phone calls you make to them. So you call the IRS. This is, I’m not making this up. This was published national news. You got like a 91% of waiting for five or 10 minutes, and then you go through another part of their phone system where it says.

Oh, we’re, you know, we’re backed up and try, try again tomorrow, click. And there’ve been a lot of cases where you get through that section, where you actually get put in the queue in the line. And you’ll sit there for literally two hours. I’ve had clients send me pictures of their cell phone, that show they’ve been on the LA line for two hours.

And. It goes click, right. And, and you’re not even in line, nobody’s calling you back. And so that’s just terrible because everybody’s taxes is big money. It’s important to all of us. And the IRS does not function like any kind of business or bank, or credit card company where you can generally get through and get your questions.

So everybody agrees all political parties that that’s no good. So they’re giving them another billion dollars. I’ll just go through this. The proposal as approved would allocate a total of 13.6 billion to the internal revenue service in the coming year. That’s their total budget. It’s up from 12.6 billion.

But the measure falls short of the 14.1 billion that the Biden administration had request. There’s long statistic. I believe it’s true that, if you hire another IRS agent they’ll raise about 10, $11,000 a day. Auditing. So, but there’s a balance, but you don’t want too many people audited or people get angry, but, but you want to do the right thing.

So what’s the right balance. But they know statistically each new audit they hire on average will raise $11,000 a day. So they say that’s right out there. All they have to do is fund it and train the people and set ’em loose. But you know, that obviously has consequences. So the, the 13.6 billion IRS total proposed funding is 6.1 billion is for enforcement.

That’s that, that is there’s a lot of enforcement, but put aside audits, there’s a lot of enforcement where there’s no dispute about what’s owed. That’s already either you filed a return and didn’t pay, or, or there’s been an audit. It’s been determined what the right number is, and they just want to try to get the money in collect what there’s no dispute about legally.

Well, there’s 6.1 billion trying to get to basically have the national collection agency being the IRS to go after resolved items and, and enforcement include. Crudes the includes the criminal investigation division going after real bad guys. Taxpayer services, 3.4 billion. That’s good.

That’s where. That’s, that’s one part where, you know, you’re working with the IRS. They need to be funded. They need to be staffed. They need to have their pensions. They have to have their coffee breaks and be adequately able to run operations support. Well that’s the phone system and other things, a number of things, 3.8 billion.

That’s up about a half a billion business system, modern modernization making it more modern. Excuse me. They’re increasing that. About a $50 million. That’s where I think they should pour a lot more money into, frankly, not that anyone cares what I think, but, IRS is relying, relying, relying on computers and the letters they send out.

You can barely read them. They, the English is bad. The processes are bad. You reply to it. And they may take six months to even read your letter. In the meantime, they might have sent you two more letters asking for money. So it’s they should monitor, monitor, modernize the computers, so that dealing with the IRS is sort of like dealing with your credit card company.

If, if there’s a problem it’s not comfortable, but at least you can read it, figure out there’s a phone call to call to get help if you need it. And so the, again, the IRS is getting more money, not as much as they wanted. And I hope that works out for ’em it’s what, what, what I I’m percolating in my mind is.

To get to the levels it used to be in the late seventies, instead of 13.6 billion, it’d probably have to be a hundred billion. The IRS had people everywhere. They were conducting audits everywhere. It was a whole different world. And I’m not encouraging that, but I’m just saying to to get to the level of, of, of service.

And coverage because they’re good guys and they’re bad guys. Most of us were out here trying to do the right thing, paying the, the correct amount of tax, not lying and cheating, just doing the right thing, but I’m not naive. And neither are you. There are people who are flat out ugly. Bad cheating.

And those folks have to get caught. And as you may know, the way the world works is that that’s not a police function. Your local city police will never go after you for taxes. That’s a, that’s a either it’s a state issue with the state tax authority or it’s a federal IRS issue. They have their own enforce.

Vehicles and, and almost never will your local police get involved no matter how bad the situation the federal agent may come to your door. If it’s really, really bad after years of ignoring them and not cooperating it could, it could happen, but it’s very, very rare. Okay. Moving on. In, in one of the bills that are being proposed by the Biden administration, we’re trying to, they’re trying to do away with the, what was called the John Edwards rule.

So let me try to give you a little background with S-CORPs. You as an owner and an active employee active person in the business, you would normally take a salary with that salary. You would have a W2 form. And with the payroll withholding, you would pay federal income tax, social security tax, Medicare tax, and any state taxes you, you would owe, but with an S Corp, you don’t have to declare all the earnings of the S Corp as.

Income. And I want to be very careful here. There’s a number of court cases. A lot of people cheat on this rule and I ain’t one of ’em. So when you have an. You have to take as salary an amount that is attributable to your personal services and contributions to the S Corp where, but however, if you have an S Corp and you have a factory and 50 employees and they’re creating revenue, well, the profits of the S Corp attributable to those functions, the factory.

Employees and so forth. Those do not have to be included in the owner’s income as W2 income. Those can be a distribution. You get the money, you have to pay taxes on it, but you don’t have to pay social security and Medicare taxes on that component. That’s outside the W2. So of course, all kinds of arguments come about as to what is reasonable compensation that goes on W2 and through full payroll withholding.

And what. The difference that can be a distribution that is not subject to those tax. Still subject to income taxes on your personal return. It’s just, there’s no payroll. Withholding and no social security and, and Medicare tax on that. So there’s whole bunch of court cases, constant controversy there, tax return, preparers who say, gee, you don’t have to take much salary.

I’m not one of those everyone I’ve heard about who has done that has ultimately gotten in trouble. I I’ll go a little political here is that the president of the United States, Joe Biden. Has two S corporations. This has all been in the public press and he did not take a reasonable salary on, on the income from those S corporations treating a huge amount of the profits from those companies as.

Distributions avoiding the social security and Medicare tax. He may have maxed on social security somewhere else. So I’m not, I don’t want to argue that he didn’t pay social security, but Medicare goes on forever. Right? Social security gets capped out at about, I think it’s 140 or 150,000. I’d have double check that Medicare goes on forever and there’s great controversy.

This is not Ron Cohen saying that you can look it up. Joe Biden’s corporations. And so far there hasn’t been to my knowledge, although it should be confidential, any IRS or department of justice work on that. But I’ll leave it at that. I’ll leave it at that. So, N knowing that. So, so John Edwards who ran for president, I don’t know, about 20 years ago he had to stop running for president because he got in trouble because of a girlfriend problem and leave that alone.

But he was a, a medical malpractice attorney and he is, he is firm. Won a huge case. And he took a salary out of his S Corp. That was his legal firm for $300,000. Approximately if my memory serves, paid social security, Medicare taxes on that, because it was on his w two. But then the firm had was like $30 million and he had gotten a distribution for millions and millions of dollars.

And he argued in a very right and plausible way saying I’ve paid my social security, Medicare tax on my base salary of 300,000 and all this other is because there’s me. And there’s 12 other lawyers. And this is because of a court case that came along. It’s not all from my personal services. I’m not required to pay social security, Medicare.

And the IRS went after him for a large amount of Medicare tax and worked its way through. And Mr. Edwards won So that’s why it’s called the John Edwards rule about how you can avoid with an S Corp this, these Medicare taxes, but you have to have the right facts again. I’ll just repeat when and I’m going to get myself in trouble, but like in the case of president Biden, who.

S Corp was involved in a book deal and his personal appearances and speeches and things related to the book deal that he wrote. I’m sure with a ghost writer, I’m not criticizing that those earnings all spawn from personal services. Well, that should be w two. Most tax professionals would tell you well, he, he didn’t do that.

So again, I want to get away from the president because that’s a very hot topic, but, but, but when, when the income is earned from your personal services directly or in directly. Then it should be on a W2 and it’s earned because your company has a factory and 30 other employees and other extraneous factors where it wasn’t your personal get up in the morning and work on this that earned the income.

Those can be treated as a distribution under current law and bypass. The mostly the Medicare tax. So the new bill that’s working its way through. We’ll see how it goes, says that for all businesses both S-corps and other pass through entities. So this is talking about partners and partnerships once the AGI, the logistic gross income of the high income taxpayer passes, $400,000.

They have to pay the 3.8% Medicare tax. On those income and the intent of this bill is extremely apparent. And they, they’re not holding back at all. They’re trying to further fund the Medicare trust fund because it’s not looking good in five or 10 or 15 years to be able to pay all of its costs. So the John Edwards rule may be on its may be in.

On its way out, both fresh Corps and partnerships. And if that affects you and it very well might please call me, call someone else, look it up on the internet. We’ll see if this gets through it all depends. On the, the current administration’s ability to pass tax laws and what they bundle up on it, a bill will have 15 different subjects in it.

Areas, some of them have nothing to do with the others. So you’ll have something with taxes and something for roads and something for space and something for the environment. Then they bundle ’em all up. And so there’s no telling. What the probability is of certain bills to get through. But we’re certainly watching that because it will directly have a significant income impact on shareholders, unlimited partners in, in various cases.

So, okay. So then moving on, excuse me for the stutter. Okay. Here in California, we have AB five assembly bill five. It passed several years ago and it basically makes almost nobody an independent contractor, meaning almost everybody is an employee in California, if you’re CPA like me, an attorney, a general contractor, a lawyer people with a state license from the state licensing board.

Well, they can be independent contractors, that’s all accepted and so forth, but just about everybody else. If you are doing anything that’s routine and habitual, habitual. Day after day, you’re taking orders from the people who are paying you not, not like you’re doing a project. You go away for a month.

You deliver a report. Nope. Nope. You’re checking in three times a day. They’re telling you what to do and how you, how to do it. There’s this thing called the ABC test under AB five. I won’t go through all that, but this was a couple years ago. We talked about it long and hard on this podcast. Pretty much.

Everybody’s an employee. Everybody has to have w two in California have to pay the state disability tax. They want you to pay state disability because the I’ve had auditors. Tell me, well, everybody, at some point in their life is going to make a claim on that state disability fund and needs some money.

Because everyone gets sick or disabled at some. And they want the funding to be as much as possible. So this whole idea, which you know, Uber drivers and so forth in the past. Folks said, well, I’m an independent contractor. I’m self-employed you don’t have to withhold taxes on me. I’ll take care of my old own taxes.

85 kind of killed that. Well, the California trucking association Wendy in and sued the who was the attorney general at time who was now Senator from California. Besera he’s there in Washington now, but this case was started back in 2019. They’ve sued saying, well, no truck drivers.

Should be able to continue to be independent contractors and they have their own reasons, but they, they want to be able to have a lot of contractors on the road who are not treated as employees, subject to payroll and w two withholding by the trucking company. So That was moving along. That case was moving along through the courts and on June 30th, the Supreme court announced that it denied, denied the California trucking Association’s petition for a hearing over a state assembly, bill five, the denial called the.

The denial called for an end of the preliminary injunction that prevented the state from enforcing the worker’s classification law on motor carriers for the last two years, that’s right. Had gone up and one of the lower courts had put an injunction saying state tax authority. You can’t enforce it until this case is resolved.

So now it’s to the us Supreme court, that’s the highest court in land in this country. And the California trucking association lost. So very soon UN well, fortunately, unfortunately I don’t want to assume how you feel about it, but a lot of truckers who have been operating as independent contractors most likely will end up as W2 employees.

The politics of it is some people say, well, that’s good. They should be paying in, have disability insurance have a worker’s compensation insurance. Be able to prefund their taxes through withholding rather than just come up with it through estimated tax. There’s all kinds of angles. You could come at this.

So I’m here to report though that the California trucking association lost the case as adjudicated in Supreme court. And so that’s the new law law of the land for truckers. Okay. So here we are just to finish up quickly. We’re in June, July 11th, 2022 for individuals and corporations, the second quarter estimated tax payments.

We’re due back on June 15th. If you are subject to those rules, you should have taken care of that or get caught up. It’s a lot more complicated because of the California pass through entity tax, which applies to cor and partnerships, lot more complicated. I could do an hour and a half on the pass through entity tax.

Plenty of things on the internet about it. That’s all I’m going to say about that. The September 15th, we have to get done partnership returns that are on extension. The on October 15th individual returns that are on extension. Our come and do so we’re busy doing all kinds of work. And I appreciate you listening to our podcast.

We’ll be back next week. Again, this is Ron Cohen. I’m a tax partner with Greenstein Rogoff Olson company. You’re in beautiful downtown Fremont, California. I can be reached at 5 10, 7, 9. 8 6, 6 1 as well as my other partners. We’re on the internet at www.Groco, GROCO.com. Thanks for listening. See you next week.

Restoring the California Dream | Lenny Mendonca

Interview transcript of Lenny Mendonca for the American Dreams Show, “Restoring the California Dream”: Alan Olsen: Can you share a little about your background? Lenny Mendonca: I went from growing up on a dairy farm in Turlock California milking cows to Harvard where I majored in economics and government. From there I went…

California, Who’s Really Running the Government? | David Crane

Interview transcript of David Crane, “California, Who’s Really Running the Government?”, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Can you share a little about your background? David Crane: I was born and raised in Denver and graduated from public high school out there. I graduated from the University of Michigan…

How Hiring An Esquire Is Revolutionizing Hiring For Contract Attorneys | Julia Shapiro

Interview transcript of Julia Shapiro, “How Hiring an Esquire is Revolutionizing Hiring for Contract Attorneys”, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Can you share a little about your background? Julia Shapiro: I was and am an attorney and I practiced at a large commercial litigation firm. I went pretty…

Allen Miner – SunBridge Group

Interview transcript of Allen Miner, SunBridge, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Welcome back and visiting here today with Allen Miner. He’s the CEO and founder of the Sunbridge group. Welcome to today’s show. Allen Miner: Great to be here. Alan Olsen: So Alan for the listeners, can you…