Established Small Businesses Need to Have a Succession Plan

Established Small Businesses Need to Have a Succession Plan

There are millions of companies in the United States, both big and small, and every size in between. Many of these businesses – somewhere in the neighborhood of about four million – are owned by baby boomers. Baby boomers have been an integral part of our country’s economic development and growth over the last several decades and some might argue that they are what make the country go. These business owners should be given a lot of credit for their effort and for helping not only themselves but also their families and many other families all across the country. However, it’s possible that many of these baby boomer business owners, especially those who own small businesses, could be making a big mistake that a lot of companies in this position make.

Why a Succession Plan Is Important

That’s because the idea of a succession plan might be something they haven’t even considered. It’s also quite possible that many of these small business owners are aware that a long-term succession plan is a good idea, but it’s something they would rather not think about. However, pushing that thought out of sight and out of mind could be very costly when it comes time for you to retire. One of the biggest problems is that many small business owners have most of their assets wrapped up together with their businesses. Plus, while most people think they’ll live forever, the fact is baby boomers typically have about 17-20 years left to live after they turn 65. You can’t put off the inevitable forever. So what should owners of established small businesses do to get a solid succession plan in place?

Things to Consider

With unprecedented amounts of money at stake as these businesses change hands over the next 10-15 years, it’s imperative to get a solid succession plan in place as soon as possible. The fact is many company owners will either have to sell, close or restructure their doors. There are several options but no matter what method you choose, make sure you do something. You could sell your business to a person or to another company, or you could transition ownership to a family member. Another option is to turn over the company to existing employees or minority shareholders. You also need to consider the timing of your turnover and plan for both the company’s transition and for your personal retirement. There are many different ways to get ready but there is no question that now is the time to start.

Experienced Business Planning You Can Trust

At GROCO, we understand business management and planning and we can help you prepare for the inevitable. If you run a small, established business and you have been putting of a succession plan then you should contact us today. We’ll help you develop a strategy that puts both you and your company in a position to be successful now and in the future. You have worked a lifetime to build our business and see it become a success. Don’t let it all go to waste by not preparing for this certainty in life that might come sooner than you think. We have the business planning experience you need to get prepared. Call us today at 1-877-CPA-2006 for more information. Or, click here to contact us online. Let’s get your business succession plan in order now, before it’s too late.

—————————————————————————————————————————————————————————————————————

We hope you found this article about “Established Small Businesses Need to Have a Succession Plan” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

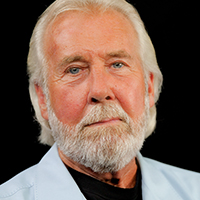

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…

Early Detection Saves Lives with Steve Marler

Steve Marler, Founder of Advanced Longevity discusses how early detection can save lives and overcoming a broken healthcare system on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to American Dreams. My guest today is Steve Marler. Steve, welcome to the show. Steve Marler Thank you. It’s great to be here. Alan Olsen So Steve,…

Preserving My Family’s Life’s Work & Legacy

Tom Chatham, Chairman of Chatham Created Gems & Diamonds, Inc., discusses preserving his family’s legacy and life’s work on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to America dreams. My guest today is Tom Chatham. Welcome to today’s show. Tom Chatham Thank you glad to be here. Alan Olsen So, Tom, we’ve had…