How to Lower Your Tax Bill in Retirement

How to Lower Your Tax Bill in Retirement

How far away are you from retirement? Are you getting closer to those so-called “golden years?” If you are then you hopefully you’ve already started preparing for your retirement with a sound plan. Retirement is supposed to be a glorious time in life. But unfortunately, for many, it turns into a nightmare because of a lack of preparation.

Retirees have a lot to consider. One of the biggest worries is often healthcare, for obvious reasons. Healthcare is expensive and it can get even worse when you don’t have a steady paycheck coming in. Having the right living conditions is also important and paying for housing can be a big stress in retirement.

Surprise! You Still Have to Pay Taxes

Another big problem retirees face is taxes. And one of the biggest reasons taxes in retirement is such a problem is that many retirees aren’t prepared for them. Many retirees think that because they’re no longer collecting a paycheck, they won’t really have to pay taxes when they retire. That couldn’t be further from the truth. The fact is retirees are still required to pay taxes on several sources of income, including pension income, withdrawals from retirement plans, and part-time work, for example.

The good news is you can take certain steps to help lower your tax bill in retirement. There are actually numerous options, but here are three common measures you can take to avoid paying as much to the IRS when you call it quits from the workplace.

Roth Retirement Plan–

traditional IRAs and 401(k)sare a great way of reducing your tax bill while you’re still working. You also get the benefit of having that money when you do finally retire. The problem is, you still have to pay taxes when you start to withdraw it. On the other hand, Roth IRAs offer you a tax-free withdrawal option. With a Roth, you’ll have to pay tax on your income upfront. However, after that money is contributed to your IRA it grows tax-free. And you can then withdraw it later, also-tax free. This can lead to big tax savings in retirement.

Up for a Move–

another option to save on taxes is to move somewhere else. Of course, this isn’t a desirable option for many retirees. However, if you don’t mind cutting ties then moving to a state that doesn’t tax Social Security will save you money for sure. However, be sure you look at all of the tax implications before you up and move. In any case, for Social Security benefits purposes only, avoid these states to lower your tax bill:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

Try Municipal Bonds–

another good way to lower your tax bill is to invest in municipal bonds. These bonds are similar to corporate bonds, but states, counties, and cities issue them. You agree to loan money for a certain period of time and collect interest payments until the due date to pay them back arrives. The good thing about municipal bonds is that the federal government does not tax those interest payments. And neither does your state or local agencies if your home state issues those bonds.

We hope you found this article about “How to Lower Your Tax Bill in Retirement” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or website www.GROCO.com.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

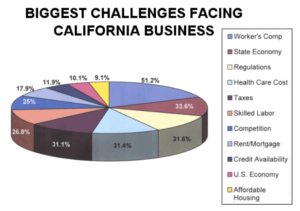

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…

15 Tips to Streamline Your Business and Become Profitable in 2007

15 Tips to Streamline Your Business and Become Profitable in 2007 By Julian Stone Here are some tips to help you ‘cut the fat’ and improve the productivity of your business. If you apply a few of these, you’re well on your way to achieving greater profit and creating less stress! Cut the SlackersCut the…

10 Ways to Increase Your Profitability

10 Ways to Increase Your Profitability “Profitability is as dependent on cutting costs as it is on increasing sales.” Profitability is as dependent on cutting costs at it is on increasing sales. As financial advisors, we are often called upon to assist management in reducing costs and finding alternatives to their unique situations. We have…