Municipal Bonds: A Source of Tax-Free Income

[vc_row][vc_column][vc_column_text]There’s one readily available and legal source of untaxed income that we know of: municipal bonds. These securities are issued by state and local governments, school districts, hospitals and other public agencies to support community projects and services. To permit these worthy endeavors to raise money economically, Uncle Sam exempts the interest that they pay from federal income tax. And state governments usually do the same for bonds issued within their borders.

As a result, these tax-free “munis” historically pay about 75%-90% of the interest that you’d earn on a taxable bond of comparable maturity and credit quality. So, depending on your tax bracket, munis actually may give you higher after-tax income.

To figure the equivalent taxable yield of a tax-free bond, divide its yield by one minus your tax rate expressed as a decimal.

If you live in a high-tax state, this advantage can be even more dramatic. Suppose that you pay an 8% state tax. Because you deduct state tax from your federal income, your effective state tax is 5.20% (8% x .65), and your combined tax rate is 40.20%. So you’d divide that 5% by .598 (1-.402) and get 8.36%. In that case, you’d prefer the 5% muni issued in your state to any comparable taxable bond paying less than 8.36%.

Types of municipal bonds

According to their issuers and their terms, munis fall into several distinct categories.

General obligation bonds are backed by the full taxing power of the city or state that issues them.

Revenue bonds pay their coupons and repay their principal from the revenues of the projects that they fund, which can be toll bridges, airports or other public facility.

Private activity bonds are issued in support of private projects, such as industrial parks or shopping malls, intended to bring business to the community. Although income from these bonds issued after August 1, 1986, is exempt from income tax, it is hit by the alternative minimum tax when earned by investors subject to the AMT. This threat tends to push the yields of these bonds up a bit, boosting their attraction for investors not affected by the AMT.

Zero-coupon municipal bonds are sold at a large discount from their face value and pay no current interest. The investor instead receives the full face value at maturity, with all the gain tax free.

Prerefunded bonds. With the relatively low interest rates of the last few years, some municipalities have issued bonds to pay for the redemption of older, higher-yielding bonds on their call date. Until that time the money is usually parked in U.S. Treasury securities. As a result, the prerefunded older munis carry an extra measure of safety.

Risk management

As with other fixed-income securities, munis are subject to two distinct types of risk: Interest rate risk refers to the fact that a bond loses value in the secondary market when interest rates rise. Nobody will pay full price for a 5% bond when new bonds are available that pay 6%. So, if you need to sell a bond in that situation, you’ll have to accept a price that will give the buyer a competitive yield.

On the other hand, if interest rates fall, the value of your bonds will rise. Don’t count your chickens, though. Most munis carry call provisions allowing the issuer to redeem the bonds early at a specified date, usually with the payment of a call premium.

Municipal bonds bought at a premium and held until maturity cannot create a capital loss. Premiums must be amortized, but a loss is possible if the bond is sold before maturity. Note that any loss that you take on the sale of a muni may be used to offset capital gains plus up to $3,000 of ordinary income. Any gain, however, may be subject to ordinary income tax (not the reduced capital gains rate).

Of course, if you hold a bond to maturity, interest rate risk is not an issue.

Credit risk refers to the possibility that the issuer will default on the timely payment of interest and/or principal. Albeit a rare occurrence, we had the 1994 example of Orange County, California, to impress this possibility upon us.

Naturally, lower-rated issues carry higher yields, but of late the spread between highquality and junk bonds has been little more than 1%. So it’s hardly worth accepting the extra risk for the marginal boost in income.

As mentioned above, prerefunding can enhance the safety of a bond. More common, however, is the use of insurance to upgrade an issue’s quality. Issuers purchase private

insurance that guarantees payment of interest and principal in the event of a default. Bonds thus covered automatically gain an S&P rating of AAA.

Another way to protect a tax-free portfolio is diversification. Bonds of different types, from widespread issuers, and of varying maturities cushion the effect of trouble in any one sector. Because most munis are issued in multiples of $5,000 or $25,000, such diversification is not possible for most individual investors. For a tax-free portfolio of less than $500,000 or so, experts recommend investing in either tax-free mutual funds or unit investment trusts. If tax-free income at the yields available currently fits your financial needs, we’re ready to help you build a working portfolio. And you won’t have to pick even one pocket.[/vc_column_text][/vc_column][/vc_row]

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

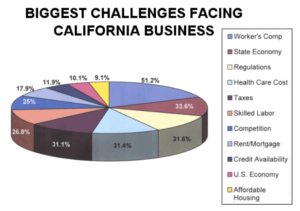

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…