IRS Wants A Lot More Than a Coke and a Smile From Coca-Cola, Co.

The Coca-Cola, Co. wants everyone to share a Coke and a smile but the IRS just wants the soft drink company to share it’s profits with the government, in the form of it’s tax bill. The IRS claims that the company has skipped out on more than $3 billion in taxes and interest due from money it earned in foreign countries. According to reports, the IRS audited Coca-Cola for the tax years 2007, 2008 and 2009. The IRS claims that the results of that audit show that the soft drink maker owes $3.3 billion in missed taxes.

So far, the IRS has not threatened Cola-Cola with any penalties. However, the agency has reportedly informed the company that it has recommended to its top lawyer that the case be litigated. For its part, Coke says that the agency’s claims have no merit. Coke is not the first American company to face these kinds of charges from the IRS, as the agency continues to fight large U.S. corporations over tax dollars for profits earned overseas. Microsoft and Amazon are also facing similar claims form the IRS.

A Coca-Cola spokesperson said that the company plans to fight the allegations and do whatever it takes legally to resolve this matter with the IRS. U.S. Corporations must pay the IRS as much as 35 percent of their total profits from around the world in taxes. However, they do not have to pay the tax on foreign profits until they move the money to the U.S. But, because the U.S. charges so much in corporate taxes, many companies simply choose to leave their foreign profits in the countries where they were earned.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

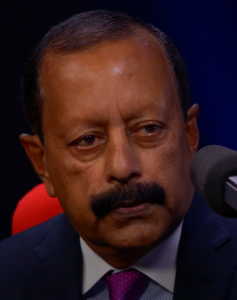

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…