Is Corporate America Getting Away With Too Little Tax?

It’s an argument that’s all too common in the business world: big multi-national companies don’t pay their fair share of taxes. A new study will only serve to add more fuel to the fire, as according to its findings, seven of the 30 biggest companies in the United States reportedly paid more to their CEOs in 2013 than they did in taxes.

The Companies

The seven companies who showed up on the list included Ford, Verizon, Boeing, General Motors, Citigroup, Chevron and JPMorgan Chase & Co. According to the study, which was conducted by the Institute for Policy Studies and the Center for Effective Government, the average CEO salary for each of these seven companies was $17.3 million.

The Other Side of the Story

However, not all of these companies agree with the numbers. For its part Verizon refutes the claim that it paid more to its CEO than it did in income taxes. The company issued a statement claiming that its total income tax bill in 2013 was $422 million. The company did not disclose a breakdown between state and federal amounts, but it did state that its CEO made much less than what it paid in federal income tax.

More Debate

All of the companies, except JPMorgan Chase, have had some kind of response to the study, and each of the companies have stressed that they abide by all tax laws and regulations, both here and abroad.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

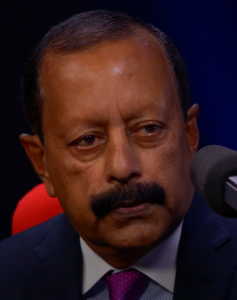

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…