Is There Still Time to File My 2016 Taxes?

Is There Still Time to File My 2016 Taxes?

The tax deadline this year has obviously passed, and most people have pushed the subject of taxes to the furthest part of their minds. However, for those who still haven’t filed a return, the tax season continues. That begs the question: is there still time to file your 2016 taxes? The answer is definitely yes. For those who filed for an extension, this comes as no surprise. However, for those who missed the deadline without filing for an extension, this may come as a surprise.

First off, if you filed for an extension, then you know you have six more months (until October 18) to file your tax return. However, you shouldn’t wait to file because even though that extension allows you more time, it does not give you more time to pay off your tax bill. Therefore, if you owe money to the IRS, you will be paying interest on the unpaid amount every month it is late.

Furthermore, whether you filed an extension or not, you should still file your return as soon as possible. The penalty for not filing is much greater than it is for filing late. Plus, when you don’t file, you not only get charged with additional interest, but the IRS also charges penalties, which are much higher than the interest rates.

One more thing to keep in mind is if you have a legitimate excuse for being late, the IRS may pardon the penalties, although you will still be responsible for any interest accrued. However, it must be a good excuse, and not having sufficient funds is not considered a good excuse.

We hope you found this article about “Is There Still Time to File My 2016 Taxes?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Investing with Style

Investing with Style How do you define your approach to investing? There may be many answers to that question. One answer goes to the style of investing that you choose: value or growth. Are you looking for value? The goal of a value investor is to seek out “bargains,” finding those companies whose stock may…

Introducing the “Total Return” Trust

Introducing the “Total Return” Trust The fundamental purpose of most trusts is to create a plan of financial protection for more than one beneficiary, often beneficiaries in different generations. “All the trust income to my surviving spouse, with the balance to be divided among our children at her death” might be used in a marital…

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

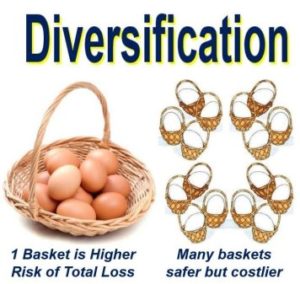

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…