Many Taxpayers Surprised by Smaller Refunds

Many Taxpayers Surprised by Smaller Refunds

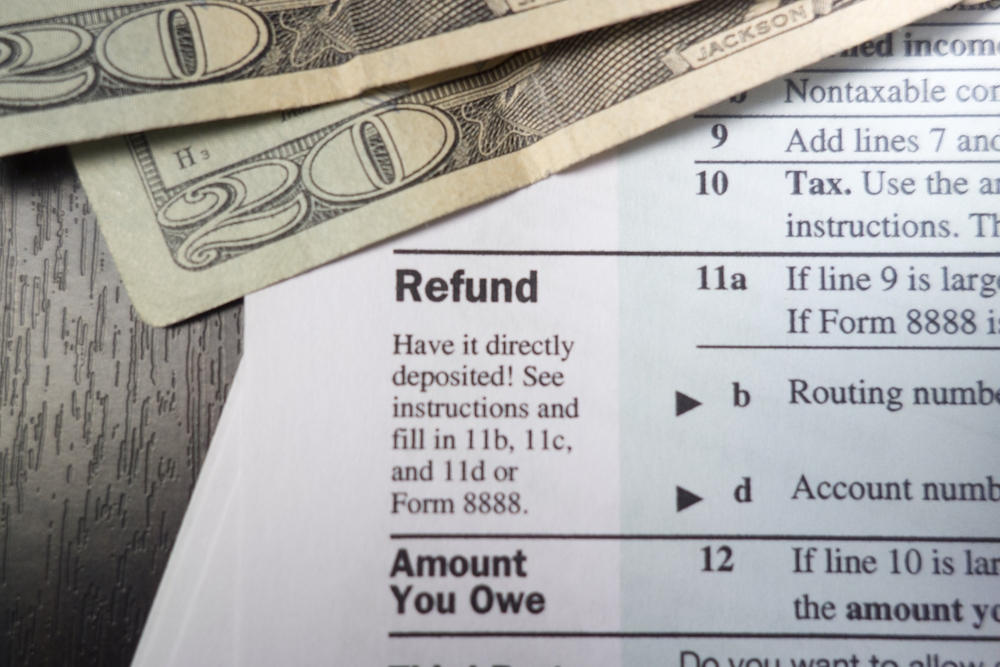

Sticker shock in the retail industry is not uncommon. But many taxpayers, this year, have been getting somewhat of a sticker shock when it comes to their tax refunds. That’s because so far this tax season, refunds have been down. Way down.

The Tax Cut and Jobs Act came with promises of a nice tax break for the middle class. So why have so many refunds been reduced? The reason is the new laws changed withholding amounts. That means taxpayers have been getting more income with each paycheck. Because less money was being withheld all year, people are getting less back in their tax refunds.

The problem is most taxpayers haven’t seen a huge difference from paycheck to paycheck. So they haven’t noticed the cumulative affect. The IRS warned taxpayers all year to check their W-4s to ensure the proper amount was being withheld. However, in many cases, taxpayers didn’t heed the warnings.

Now that tax season is here, most taxpayers are expecting their usual refunds. But that’s just not happening, which is leaving numerous taxpayers upset. However, the truth is, you don’t want to have a large refund because that money belongs to you all year. The new tax laws make it so you get it up front, instead of waiting until the following tax season.

But it might take some time for taxpayers to get used to the changes.

We hope you found this article about “Many Taxpayers Surprised by Smaller Refunds” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Tax Forms & Publications

Tax Forms & Publications The publications listed below are located on the IRS web site and require Adobe Acrobat to view. Visit the Adobe Web Site to install the latest version of Acrobat Reader. Publication 1 Your Rights As a Taxpayer Publication 3 Armed Forces’ Tax Guide Publication 15 Circular E, Employer’s Tax Guide Publication…

Hall Of Laughter

Hall Of Laughter In memory of Steve Gardner 1958-2010 Thanks for the accounting humor and endless hours of laughter. We love you! Three Blind Mice Audit The IRS Agent uses a math joke in his audit of the three blind mice. Accounting Puppets 2 Puppets tell Accounting and Audit Jokes. Accounting Puppets Puppets tell Accounting…

The Roth Way to Riches

The Roth Way to Riches By Roy Lewis With all the recent tax-code changes, it seems a number of taxpayers have forgotten the Roth IRA. That’s a shame, because it’s far more than an ordinary retirement savings account. Roth IRAs are tax-favored accounts to which qualified taxpayers can make non-deductible, after-tax contributions. Those contributions can…

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) Medicare legislation enacted in December 2003 provides for a prescription drug benefit that won’t exist until 2006. But also part of the new law is a provision that went into effect on January 1, 2004—the creation of the Health Savings Account (HSA). By opening an HSA, you may be allowed to…