Mark Cuban’s Take on Donald Trump’s Taxes

Mark Cuban’s Take on Donald Trump’s Taxes

If you follow the presidential election then you know that this year’s run for the Oval Office is perhaps one of the most spite-filled elections our country has ever faced. According to many political pundits, talking heads in the media and dozens of poll results, the last two candidates standing – Donald Trump and Hillary Clinton – are the two least-likable presidential candidates of all time. Whether you agree with that sentiment or not, the perception among many is that this election will finish with one of the country’s most unpopular presidents of all time in the White House. There are many complaints about both candidates but throughout the entire election process one of the continuing outcries has been for Mr. Trump to release his tax returns.

Should He or Shouldn’t He?

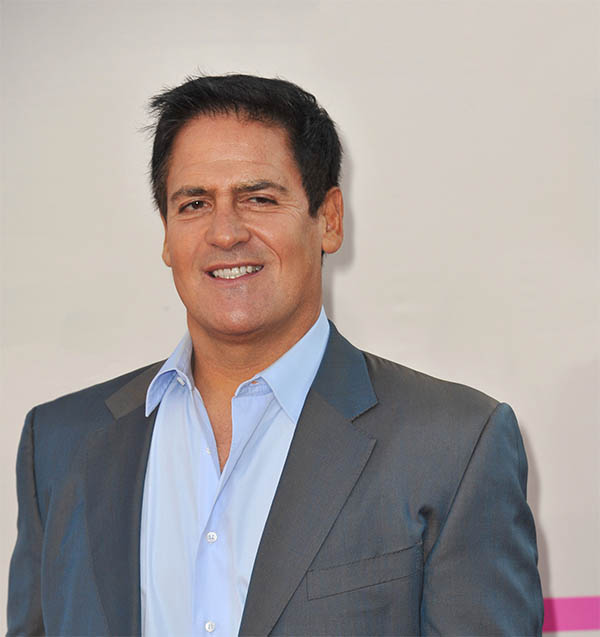

So far, Mr. Trump has not given in to those demands. His opponent has released her tax returns and has joined in the call for Mr. Trump to do the same. Many claim that Mr. Trump’s refusal to make his returns public is just more evidence that he has something to hide, which many say is another strike against him. However, not everyone thinks his refusal to turn over his tax returns to the public is a sign of something terrible. In fact, another billionaire that has come out and stated that he will be supporting Mrs. Clinton in November says Mr. Trump’s refusal to share his tax returns isn’t a big deal at all. Mark Cuban, Venture Capitalist and host of Shark Tank doesn’t really think Mr. Trump has anything to hide.

Do Tax Returns Really Matter in the Election?

The owner of the NBA’s Dallas Mavericks, Magnolia Pictures, and Landmark Theatres and the chairman of the HDTV cable network AXS TV, Mr. Cuban recently said in an interview that the fact that Mr. Trump won’t make his returns public is irrelevant. “I know for my taxes, when it’s tax time there’s a big living room table that I have and there’s big stacks of paper all over the table. I just look at the signature pages and it takes me 45 minutes still just to sign all that stuff.” In fact, before this year (because he actually looked this time), Mr. Cuban said in any previous year he couldn’t have told anyone how much he made or what was on his taxes. “It certainly was not a reflection of net worth or of how much anyone gives to charity or anything. Any one given year may be up or down, so I don’t care if they release their taxes.”

Perhaps It’s Brand Protection

When asked why he thinks Mr. Trump is not releasing his taxes, Mr. Cuban said he really had no idea, but his best guess is that it might have been a down year for Mr. Trump so he doesn’t really want to share that information. “He may have taken a negative income last year and that certainly doesn’t match up to his brand. So it doesn’t matter.”

To read more on Trump’s Tax returns click here.

We hope you found this article about “Mark Cuban’s Take on Donald Trump’s Taxes” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Tax Preparers Get Busted for Fraudulent Practices

Every tax season is full of stories and tales of people who go to great lengths to avoid paying taxes. In addition there are dozens of reports of unscrupulous tax preparers that get caught trying to cheat the system: either their clients or the IRS, or both. We want to share a few of those…

Entrepreneur Think Deductions, Deductions, Deductions!

Are you an entrepreneur looking for a tax break? Entrepreneurs have a lot on their plate, including living with the financial risk of their entrepreneurial efforts. That’s why it’s so important for any entrepreneur to be aware of any and all deductions come tax time. There are dozens of deductions to be had, but the…

Late Obamacare Forms Could Be Big Problem for Taxpayers

While you may or may not like Obamacare, the fact is the president’s health care plan has caused problems at tax time since its inception. Apparently, this year is no different. According to a recent report, because of a delay in new tax forms for the health law this year, many taxpayers are facing more…

Don’t Forget About These Important Tax Write-Offs

The saying goes that it’s the small victories that count. That saying can be especially true during tax time when for many taxpayers any chance to save even a few dollars more is considered a positive. Plus, when you add up enough of the small victories they can equal a significant reward. With that in…