Millionaire Taxes- The Debate is On

Millionaire Taxes- The Debate is On. How many people are millionaires in the United States? According to recent statistics the number of people in the country with a net income of $1 million or more reached 9.63 million in 2013. That might sound like a lot, but compared to the total U.S. population that number is actually quite small. Regardless, there is no argument that the wealthy are taxed more than the middle class. However, according to a recent report, many people who aren’t actually in the wealthy category are still being taxed like they are.

Targeting the Wealthy

Nearly a dozen states have either raised or tried to raise taxes on the wealthy recently, including both New Jersey and Illinois, who recently voted against such measures. However, since 2009, 10 states have either raised income taxes for all taxpayers or for those in the highest tax bracket. Another state, Washington, rejected an increase on the wealthy in 2010.

The Affluent Hurt the Most

Of course, the wealthy will always be taxed more, but most, if not all of these states are actually nailing those taxpayers in the affluent category as well. In fact, it seems that these so-called “millionaire taxes” are not just for millionaires. Often, people who make $200,000 are also hit with a higher tax rate and in some cases, such as in the state of Maryland, single people who make as little as $100,000 ($150,000 or more for joint filers) in a year are subject to a higher tax rate. In the recent past California and Minnesota have also adopted new tax brackets for those who make more than $250,000.

The Consequences

Many economists argue that taxing the wealthy is not a good way to help the economy, especially in the long run. Evidence suggests that forcing the wealthy to pay more taxes actually hurts the country’s productivity and its economic growth. Another problem that states face is losing companies altogether. Many corporations have recently packed up and moved from states with high corporate and income taxes to states where the tax bill is much lower.

Not Giving Up

However, despite the fact that there are several negative aspects of raising taxes for the wealthy, there are many who still think that’s the best method to help boost the economy and create more economic equality. That’s why so many states continue to introduce legislation designed to penalize the wealthy.

Never-Ending Battle

The bottom line, when it comes to the so-called “millionaire tax” the debate will never end. Those who think the wealthy should pay more will continue to argue their point. That includes lawmakers who will most certainly continue to push legislation aimed with that goal in mind. On the other side of the equation, those who oppose taxing the wealthy unfairly will continue to fight theses efforts.

GROCO – A Wise Investment

In any case, the wealthy are already heavily taxed, which means it’s important for them to utilize every tax break and advantage they can get in order to keep as much of their money as possible. That’s why contacting GROCO is a smart investment. We can help you maximize your tax planning and thereby get the most out of your income tax return.

We hope you found this article about “Millionaire Taxes- The Debate is On” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

Alan L. Olsen, CPA, Wikipedia Bio

Proud sponsor of the AD Show.

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

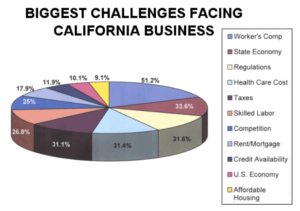

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…