New Jersey Governor Says Enough is Enough on Taxing the Wealthy

New Jersey Governor Says Enough is Enough on Taxing the Wealthy

It seems that no tax is a bad tax when it comes to the “left” side of the government. It’s a well-known fact that the wealthiest Americans pay the largest portion of the country’s taxes. However, there are some government leaders that lean “right” who still think that the rich already pay more than their fair share of their income to the government.

Rich fair share

To that end, Gov. Chris Christie of New Jersey recently vetoed more tax increases that would have raised the state’s tax bill by more than $1 billion. Meantime, Gov. Christie also noted that the need for serious tax reform across-the-board is overdue. Gov. Christie recently signed New Jersey’s budget and pointed out that the state’s richest 1 percent are already paying around 40 percent of the total tax bill.

Wealthy are concerned

Gov. Christie is concerned that if the state continues to increase the tax bill for the wealthy they will simply decide to live elsewhere. Gov. Christie also noted that the state lost around $70 billion in the five years after the last major tax hikes in 2003 and 2004.

There’s no question that the government already takes enough from the wealthiest people in America. At GROCO we agree with Gov. Christie that tax reform is needed and not more taxes to the wealthy. Although paying taxes is important, we focus on helping you keep as much of your money as you are allowed by law. Contact us today for help with your tax planning.

We hope you found this interview “The Evolution of Business Education” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm with clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of Alan Olsen’s American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

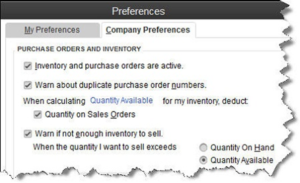

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…

Thinking About Giving up Your U.S. Citizenship? Think Twice

Thinking About Giving up Your U.S. Citizenship? Think Twice While not a lot of people ever entertain the thought of giving up their U.S. citizenship, there are more people every year that are making that choice. Among them are several wealthier people whose main reason for renouncing is to escape the country’s overloaded tax system;…