Not Your Mother’s Pants!

What happens when you mix a charitable auction with a famous pair of pants from an iconic movie worn by a legendary international superstar? A six-figure donation to cancer research and a lot of very happy people…

On November 2, 2019, the Estate of Olivia Newton-John listed several items on Julien’s Auction. The famous actor was battling cancer for the third time[1] and the Hollywood star was donating the proceeds of a very special pair of her pants towards the Olivia Newton-John Cancer Wellness & Research Centre.

The description read,

A pair of custom-made stretch satin, figure-hugging, black high-waist pants worn by Olivia Newton-John in the finale of Grease (Paramount, 1978) when she and John Travolta perform “You’re the One That I Want” and “We Go Together”… Estimated value of the item: $40,000 – $60,000.[2]

There were only four prior bids on the pants until they sold for $162,500. Sarah Blakely, who is a successful entrepreneur, revealed herself as the buyer on, “CBS This Morning” saying, “I have been the biggest fan of Olivia since I was a little girl, since ‘Grease’ came out, and my friend called me two days before the auction. I didn’t know it was happening … and I thought… I’ve got to try to get these.”[3]

The outlandish price Blakely paid for her new collector pants, albeit for a worthy cause, garnered the white hot media spotlight, but there is another side of the story that was not covered. As a family office consultancy firm, we thought we would take the opportunity to discuss the tax implications of purchasing and donating collectibles at charity auctions.

Auction Benefits for the Buyer

Purchases made at charity auctions may be claimed as tax deductions as they are considered charitable contributions. You can’t claim the entire purchase price of item though- your deduction is limited to the amount that you spend beyond the items fair market value. In Blakey’s case, her charitable contribution would have been between $122,500 and $102,500 ($162,500 purchase price less the $40,000 – $60,000 range of appraised value). A key element of being able to claim this deduction though is having the ability to show the IRS that the buyer was knowingly paying beyond the fair market value of the item. Blakely was covered in this case as the auction had published the appraised value of the pants on their site before the bidding began.[4]

Benefits for the Donor

Buyers are the only ones that can receive benefits at auctions. Donors may also claim deductions however the amount that they can deduct is not quite as straight forward as that of the buyer. Most donors would assume that they can claim their property’s fair market value as a charitable contribution, however when it comes to appreciated collectibles, it’s not that simple. The IRS states:

“Under these circumstances, the law limits a donor’s charitable deduction to the donor’s tax basis in the contributed property and does not permit the donor to claim a fair market value charitable deduction for the contribution. Specifically, the Treasury Regulations under section 170 provide that if a donor contributes tangible personal property to a charity that is put to an unrelated use, the donor’s contribution is limited to the donor’s tax basis in the contributed property. The term unrelated use means a use that is unrelated to the charity’s exempt purposes or function, or, in the case of a governmental unit, a use of the contributed property for other than exclusively public purposes. The sale of an item is considered unrelated, even if the sale raises money for the charity to use in its programs.”[5]

When one is making a donation that will be sold at a charity auction, the deduction is limited to your tax basis and not what the actual item is worth. Now keep in mind that the limitation of your deduction does not apply to donating appreciated socks and other securities, but to personal property.

If you have any questions on charitable donation tax strategies, collectible capital gains tax rates or if you’re in need of objective tax and family office advice (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

Alan L. Olsen, CPA, Wikipedia Bio

[1] https://www.rollingstone.com/movies/movie-news/olivia-newton-john-cancer-722161/

[2] https://www.julienslive.com/m/lot-details/index/catalog/315/lot/125379?url=%2Fm%2Fview-auctions%2Fcatalog%2Fid%2F315%3Fpage%3D1%26view%3Dlist%26key%3Dgrease%26sale%3Dundefined%26catm%3Dany%26order%3Dorder_num%26xclosed%3Dno%26featured%3Dno

[3] https://www.msn.com/en-gb/money/news/20-of-the-most-expensive-celebrity-memorabilia-items-ever-sold-at-auction/ss-AAJUpjP#image=2

[4] https://www.irs.gov/charities-non-profits/charitable-organizations/charity-auctions

[5] https://www.irs.gov/charities-non-profits/charitable-organizations/charity-auctions

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

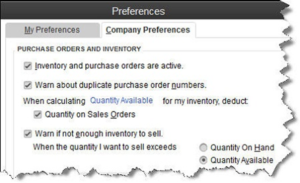

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…

Thinking About Giving up Your U.S. Citizenship? Think Twice

Thinking About Giving up Your U.S. Citizenship? Think Twice While not a lot of people ever entertain the thought of giving up their U.S. citizenship, there are more people every year that are making that choice. Among them are several wealthier people whose main reason for renouncing is to escape the country’s overloaded tax system;…