Trust Your Tax Return to the Professionals

A question millions of US citizens annually ask themselves prior to April 15th.

Should you DIY or trust your tax return to the professionals?

Every year many thousands of modest, honest and hardworking US citizens discover they owe the IRS still more money upon completion of their tax returns. It’s a lousy feeling. Now imagine, instead of owing hundreds or thousands of dollars, you owe hundreds of millions of dollars in unpaid taxes? How would that feel?

That’s exactly what happened to one Colorado woman. Upon completion of her return she stared in disbelief and horror at the amount of taxes owed, $216,399,508. The taxpayer in question is a part-time worker who makes about $10 an hour at a thrift store. The woman decided to prepare her own taxes and used Turbo Tax, a popular tax software application.

Because of a glitch in the IRS software, Turbo Tax made an error related to the woman’s federal taxable income.

The company did confirm the error on its part and it’s working to resolve the issue. According to reports, there were several taxpayers in Colorado who experienced similar issues.

Preparing your own taxes can save you some money. But in these cases, not time nor peace of mind. Having an experienced tax professional and accounting firm do you tax preparation for you is always a good idea, particularly if your tax or financial situation is complicated. If you have a complicated tax issue, we suggest contacting your current expert tax prepare.

We hope you found this article about “Trust Your Tax Return to the Professionals” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

Alan L. Olsen, CPA, Wikipedia Bio

Proud sponsor of the AD Show.

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

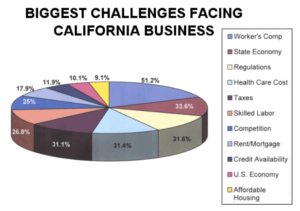

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…