Secondary Market May Impact 409A Valuations

Secondary Market May Impact 409A Valuations

An issue gaining attention with respect to 409A valuations is the fact that many private company shares are increasingly being traded in the secondary market. There is a debate among valuation specialists over how transactions in private company stock impact the value of the company securities for 409A purposes.

The AICPA guidelines state that a recent private market transaction in the stock of a company is considered as the most relevant data point in reaching a conclusion of value for 409A purposes.

However, before considering those transactions, a valuation analyst should analyze the following issues:

The nature of the stock:

Were there preferred stocks or common stocks sold?

Preferred stock transactions are less relevant than common stock transactions since preferred stocks have liquidation preferences and often more rights than common stocks.

Timing: Did the transaction occur close to the valuation date?

A transaction that occurred more than 12 months prior to the valuation date has less impact on the valuation. Material events that occurred after the transaction should be considered since they might have changed the company’s fair market value.

Volume of the transaction: How many buyers and sellers? How many shares?

Small transactions between a few people are less relevant than larger transactions between many participants. It is also important to understand what percentage the transaction represents of the fully diluted equity capitalization of the company.

Available financial information: Was the buyer well informed?

The definition of “Fair market value” assumes that the buyer and the seller have access to an adequate amount of information. Unlike public traded companies, there is often little or no information about companies trading in a private market.

If the buyer is a board member with access to regular financial reports or if the buyer proceeds to a full due diligence process, the transaction will have more impact on the 409A valuation than transactions occurring on marketplaces like Sharespost or SecondMarket.

Buyer/seller motivation: Were the parties independent? Was it a strategic investment?

This is probably the toughest question to answer whether the parties were independent and what were their motivations. The definition of “Fair market value” assumes that neither the seller nor the buyer should be compelled to buy or to sell.

The prices paid by investors in equity financing transactions may be complicated by considerations beyond investment such as establishing a strategic relationship or providing liquidity to company founders.

Strategic Investments. The buyer may have other business motives for making the investment which is beyond earning an investment return such as building a strategic business relationship, gaining access to information and influence or obtaining a preferential position as a supplier or customer.

In this scenario, the price paid may be overstated and the implied value of the company may be misleading.

Liquidity to company founders or key employees. Some Preferred Shareholders or companies buy common stock from founders or key employees to provide the liquidity. As such, the parties are protecting their investment by paying a premium to the founders or key employees, upon whom the future success of the company is highly dependent.

Mostly in these cases, the price offered to a select group of shareholders who are considered to be integral to the future success of the Company is not proposed to all of the Common Shareholders. Consequently, the price paid may be overstated as well.

Bundled Transactions. In some instances, the investors complete an equity financing round including a combination of the latest series of preferred stock, an earlier series of preferred stock and common stock at the same price per share. The common stock price may not seem reasonable given the facts and may be overstated.

Based on the factors explained above, a valuation analyst should carefully analyze the nature of the transactions in privately-held companies before considering their impact on 409A valuations.

Qualifications of Business Valuation Analysts:

The management should carefully consider the education, specialization and credential of a business valuation analyst. The dedicated Business Valuation group at Greenstein Rogoff Olsen & Company (GROCO) provides the expertise of a large big four firm with the hands on individualized service of a small local firm with regional prices.

We are committed to provide our clients and their advisors with the highest services and support available.

Our business valuation analysts are certified as accredited valuation analyst from the National Associate of Certified Valuation Analysts and have work experience with the big four accounting firms. GROCO is a full-service certified public accounting firm, advising and assisting our clients with their accounting, tax, wealth preservation and business valuation needs.

Our business valuations group has preformed hundreds of valuations of privately held corporations and businesses totaling over $3 Billion in appraised values.

This experience includes over sixty-five different industries all geographical regions of the US and all stages of enterprise development, with particular emphasis on early stage companies in the Silicon Valley.

For more information contact Alan Olsen, Managing Partner, at aolsen@groco.com.

We hope you found this article about “Secondary Market May Impact 409A Valuations” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Investing with Style

Investing with Style How do you define your approach to investing? There may be many answers to that question. One answer goes to the style of investing that you choose: value or growth. Are you looking for value? The goal of a value investor is to seek out “bargains,” finding those companies whose stock may…

Introducing the “Total Return” Trust

Introducing the “Total Return” Trust The fundamental purpose of most trusts is to create a plan of financial protection for more than one beneficiary, often beneficiaries in different generations. “All the trust income to my surviving spouse, with the balance to be divided among our children at her death” might be used in a marital…

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

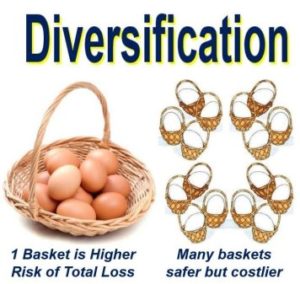

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…