Want to Keep Your Passport – Pay Your Tax Debt

Want to Keep Your Passport – Pay Your Tax Debt. Are you planning an exciting vacation abroad any time soon, or an important overseas business trip? Before you leave the country, you better make sure you don’t owe any back taxes.

The IRS recently reminded taxpayers that if they have a tax debt of greater than $50,000.00, they could be in jeopardy of losing their passports. If the IRS notifies the State Department of your tax liability, then your passport can simply be revoked.

Again, this is for taxpayers with “seriously delinquent” tax debt. Additionally, if you have already set up a payment plan with the IRS and you’re sticking to it, then the agency is not supposed to report you to the State Department. And if you are subject to losing your passport, the IRS is required to send you a letter notifying you. In that notice, the agency also informs you of what you need to do to resolve the issue. You will then have 30 days to act before the IRS takes further action.

Therefore, be mindful of large tax liabilities when contemplating travelling abroad and negotiate a payment plan with the IRS well before making any such plans. Particularly if your tax or financial situation is complicated; in which case, we strongly suggest contacting your current tax professional.

If however, you’re in the market for a new, trusted tax and family office advisor, we never sell investments, please consider contacting us here at Info@GROCO.com. Unfortunately, we no longer give advice to other tax professionals.

We hope you found this article about “Want to Keep Your Passport – Pay Your Tax Debt” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

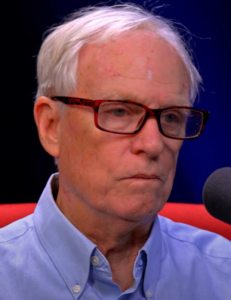

Alan L. Olsen, CPA, Wikipedia Bio

Proud sponsor of the AD Show.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

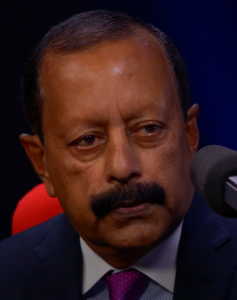

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…

The Man Behind Morganstar Media | Randall Morgan

Interview transcript of Randall Morgan for the American Dreams Show, “The Man Behind Morganstar Media”: Alan Olsen: Can you tell us about your background and how you ended up working with Jane Goodall? Randall Morgan: I was a graduate student at Stanford, and had just finished my masters in documentary film, in walks Jane…