How to Choose Your Tax Filing Status if You’re Married

If you’re married then you’ve probably just always filed a joint return with your spouse. In fact, chances are you’ve never even considered filing any other way. However, for some people, married filing jointly is not the best option. Depending on your situation, it could be more advantageous to file separately. Here are some things to consider when choosing what filing status to use if you are married.

While in many cases, filing together could help lessen the tax hit on you and your spouse it doesn’t always work that way. Sometimes, the only advantage of filing jointly is that you only have to worry about one return. If you and your spouse both work and one of you earns a lot more than the other, then it will typically be better to file jointly, as it will usually help reduce your combined tax bill.

On the other hand, there are other circumstances wherein it that might better to file separately. For example, if you both have taxable income and one of you has a lot of itemized deductions limited by adjusted gross income (AGI), then it might make sense to file separately. That’s because by filing separately, you can also separate both of your AGI’s. If your AGIs are lower on your separate returns, you can save on your tax bill.

This is just one example of where filing separately from your spouse could be helpful. However, it’s best to weigh all your options before making that choice. If you’re not sure what status to choose, you can contact us at GROCO for help. We’ll look at all the numbers and all the possible scenarios and choose the best path for you. Call us at 1-877-CPA-2006, or click here.

The Man Behind Morganstar Media | Randall Morgan

Interview transcript of Randall Morgan for the American Dreams Show, “The Man Behind Morganstar Media”: Alan Olsen: Can you tell us about your background and how you ended up working with Jane Goodall? Randall Morgan: I was a graduate student at Stanford, and had just finished my masters in documentary film, in walks Jane…

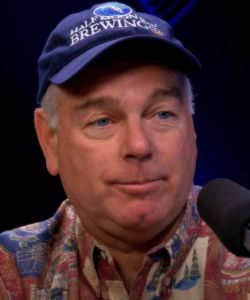

Restoring the California Dream | Lenny Mendonca

Interview transcript of Lenny Mendonca for the American Dreams Show, “Restoring the California Dream”: Alan Olsen: Can you share a little about your background? Lenny Mendonca: I went from growing up on a dairy farm in Turlock California milking cows to Harvard where I majored in economics and government. From there I went…

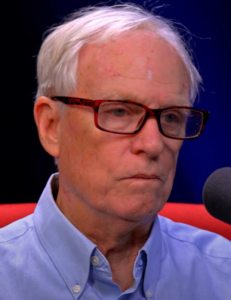

California, Who’s Really Running the Government? | David Crane

Interview transcript of David Crane, “California, Who’s Really Running the Government?”, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Can you share a little about your background? David Crane: I was born and raised in Denver and graduated from public high school out there. I graduated from the University of Michigan…

How Hiring An Esquire Is Revolutionizing Hiring For Contract Attorneys | Julia Shapiro

Interview transcript of Julia Shapiro, “How Hiring an Esquire is Revolutionizing Hiring for Contract Attorneys”, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Can you share a little about your background? Julia Shapiro: I was and am an attorney and I practiced at a large commercial litigation firm. I went pretty…