How Will the New President Change Taxes for the Wealthy?

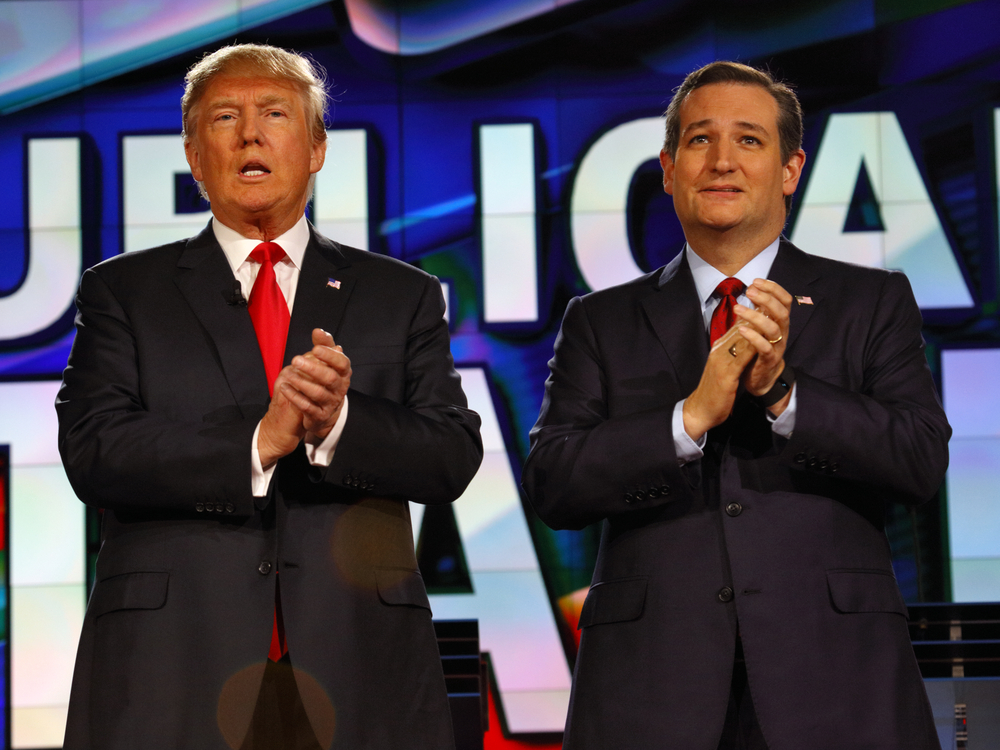

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Learning to Lead by Example

Learning to Lead by Example Each morning, the mirror reminds us of at least one person whose motives should meet all of our expectations. There is no limit to what an army of these individuals can accomplish. As you live your life if a way in which you are daily striving to reach your full…

America Taking Money From Its New Citizens?

America Taking Money From Its New Citizens? According to various government reports, there are literally trillions of dollars being hidden in offshore accounts by Americans who don’t want to pay their fair share of taxes. Of course, everyone should have to pay his or her fair share to Uncle Sam, but no one should be…

Where Can You Find the World’s Best Tax Havens?

Where Can You Find the World’s Best Tax Havens? What’s your next vacation location: the Caribbean Tahiti, Bermuda, Belize, the Virgin Islands, or perhaps the Cayman Islands? These are all great choices and many of the world’s wealthiest individuals not only get to travel to these exotic locations on a regular basis, but many of…

Enjoy Them While They Last: End of Bush Tax Cuts Could Throw U.S. into Deeper Recession

Enjoy Them While They Last: End of Bush Tax Cuts Could Throw U.S. into Deeper Recession A few Senate Democrats recently made noise over ending the Bush Tax Cuts in January 2011 given the country’s economic prospects. Although many people have predicted that the end of the Bush Tax Cuts is a foregone conclusion, a…