How Will the New President Change Taxes for the Wealthy?

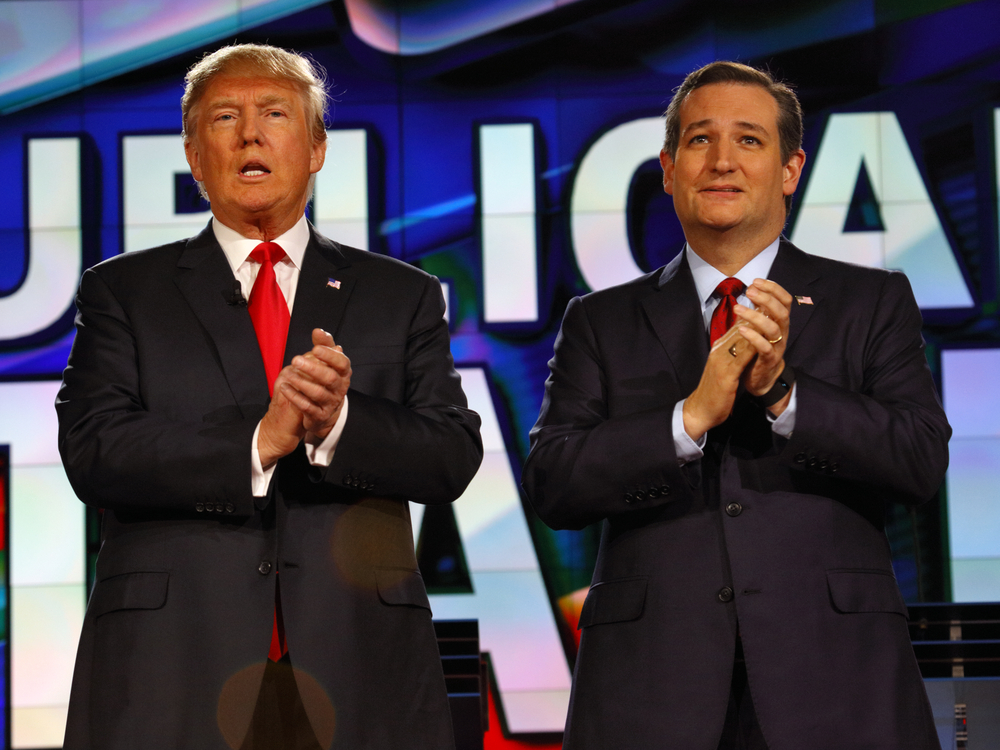

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Will True Tax Reform Happen in Our Lifetime?

Will True Tax Reform Happen in Our Lifetime? Will explorers ever truly discover the Fountain of Youth? Will the Cubs ever win the World Series? Will Elvis ever be found alive? There are so many questions that might not ever be answered in our lifetime. Here’s another one: will we ever see true tax reform…

Bookkeeping: What Kind of Records Should I Keep?

Bookkeeping: What Kind of Records Should I Keep? You may choose any recordkeeping system suited to your business that clearly shows your income and expenses. Except in a few cases, the law does not require any special kind of records. However, the business you are in affects the type of records you need to keep…

Tips to Help Taxpayers with January 31 Tax Season Opening

We are again suggesting some tips to help taxpayers with the January 31 tax season opening. The IRS will begin processing most individual income tax returns on Jan. 31 after updating forms and completing programming and testing of its processing systems. The IRS anticipated many of the tax law changes made by Congress under the…

Looks Like More Wealthy Americans Are Saying Goodbye to the U.S.

The country just got done celebrating its independence this past weekend. With fireworks and all kinds of parties, Americans celebrated to show their appreciation for one of the greatest gifts they have: Freedom. Most Americans are very proud of their citizenship, even if they don’t always like everything the about the laws of the land.…