How Will the New President Change Taxes for the Wealthy?

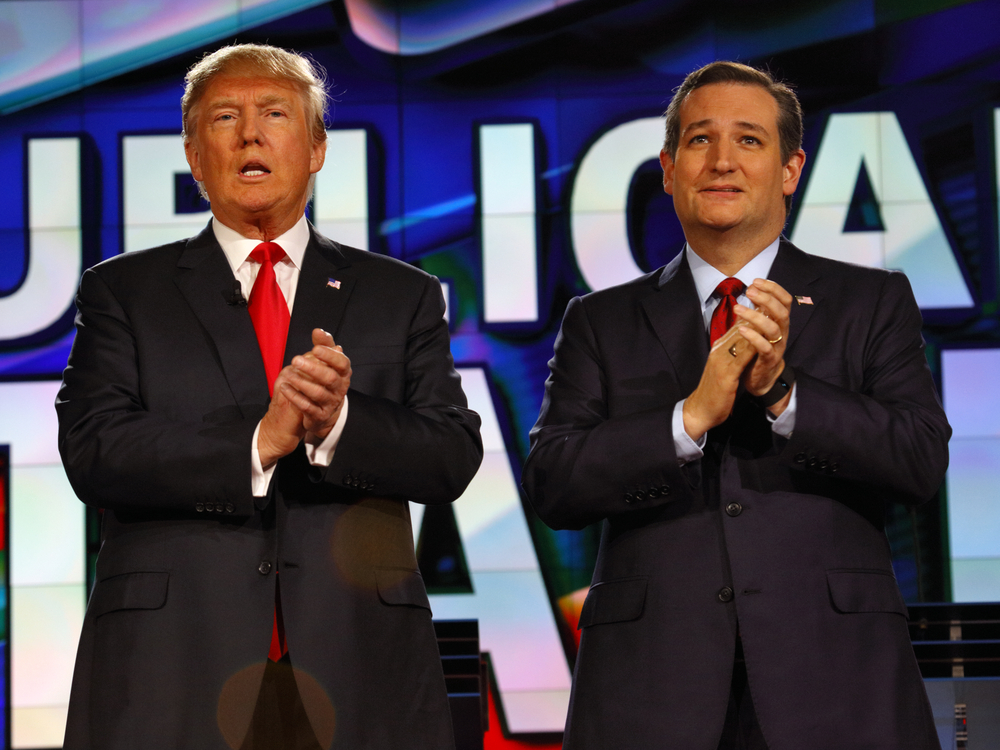

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Republican Lawmaker Pushing Real Tax Reform

Republican Lawmaker Pushing Real Tax Reform By Kent Livingston Will our country ever see true tax reform? While politicians continue to battle over who should pay what and who is getting away with highway robbery, none of them seem to be able to come up with a better plan to actually fix our country’s broken…

Six Facts About the American Opportunity Tax Credit

Six Facts About the American Opportunity Tax Credit Many parents and college students will be able to offset the cost of college over the next two years under the new American Opportunity Tax Credit. This tax credit is part of the American Recovery and Reinvestment Act of 2009. Here are six important facts the IRS…

Small Businesses, Bite a Chunk Out of Your Taxes!

Small Businesses, Bite a Chunk Out of Your Taxes! A tax savvy entrepreneur like yourself probably knows that maximizing your deductible business expenses lowers your taxable profit. After all it is how much money you have left in your pocket that sometimes matter. Here are some deductions which may help you take a bite out…

Tax Strategies for the Wealthy: Qualified Personal Residence Trust (QPRT)

Tax Strategies for the Wealthy: Qualified Personal Residence Trust (QPRT) Wealth management is an important issue for those with substantial assets to protect. Many people incorrectly assume that their estates will escape federal estate tax as a result of underestimating what their principal residence will be worth when they die. Often, our homes are our…