How Will the New President Change Taxes for the Wealthy?

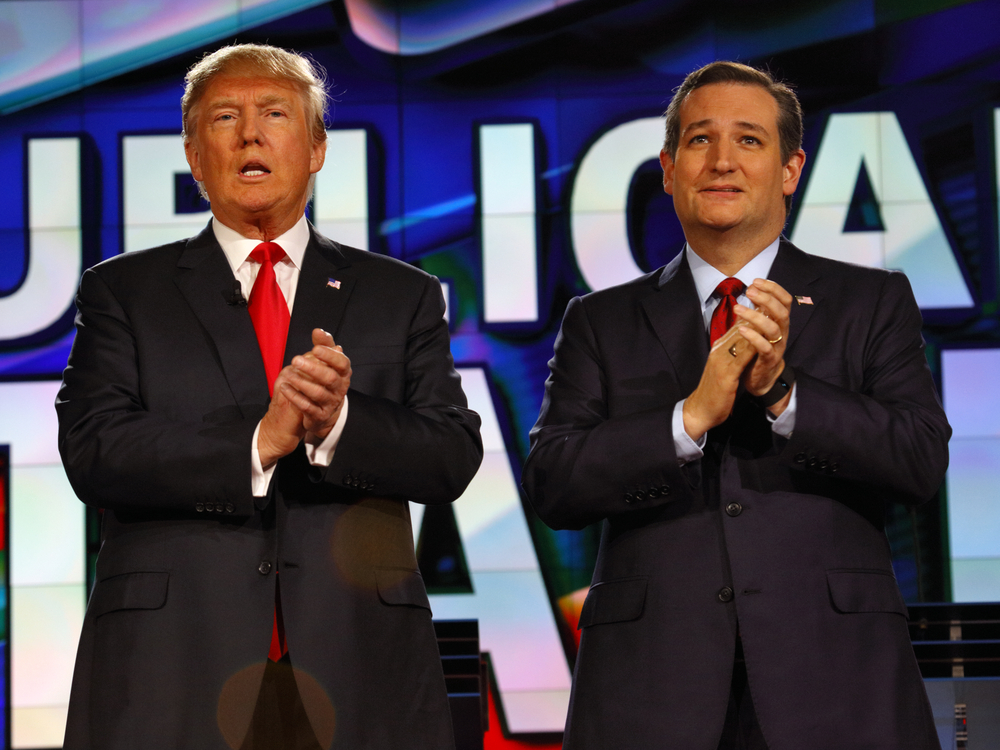

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

The Language of Trusts

The Language of Trusts Many professions and disciplines have their own vocabulary. As an example, think about the terminology used in medicine and law. Often this vocabulary defines complex ideas, yet just as often “terms of art” can be defined with relative ease to a layperson. Such is the case with much of the language…

Tax Planning Considerations

Tax Planning Considerations First Year Tax Issues Upon Becoming a US Resident If a married taxpayer wishes to file a joint return, both spouses must be residents at the end of the year and elect to be treated as U.S. residents for the entire year. If the taxpayer is taxed as a U.S. resident for…

Approaches to Valuing Cost Sharing Buy-Ins

Approaches to Valuing Cost Sharing Buy-Ins Buy-Ins: Introduction Buy-in payments are often associated with a cost sharing arrangement (CSA) transaction. See § 1.482-7 for regulations regarding cost sharing arrangements between related parties. Participants should receive arm’s length compensation (a “buy-in”) for “pre-existing” intangibles that are contributed to a CSA. The buy-in should be treated as…

IRS Says Its Auditors May Routinely Ask for Effective Tax Rate Reconciliation Workpapers

IRS Says Its Auditors May Routinely Ask for Effective Tax Rate Reconciliation Workpapers Chief Counsel Notice 2007-015 A Chief Counsel Notice concludes that effective tax rate reconciliation workpapers are neither tax accrual workpapers nor audit workpapers. As such, they aren’t included in the documents the IRS will not routinely request during an audit. Effective tax…