How Will the New President Change Taxes for the Wealthy?

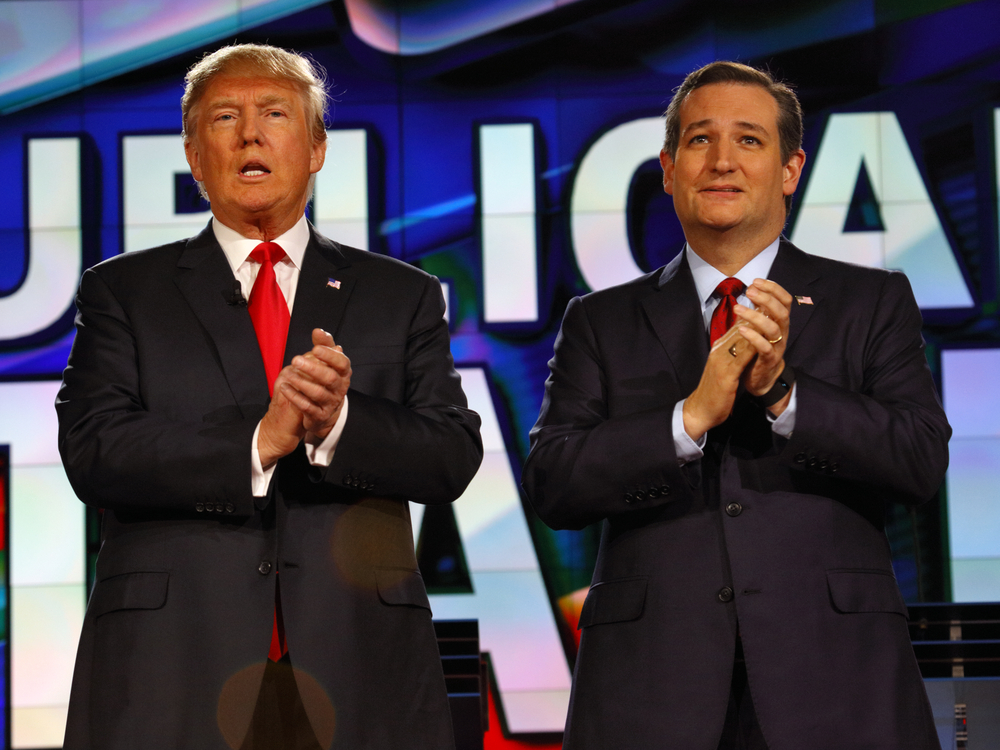

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Choosing a Business Entity that is Right for You

Choosing a Business Entity that is Right for You Have you decided to venture out on an entrepreneurial limb? If yes, there is an array of business structures that you can choose from. There are different tax liabilities dependent upon which business structure that you choose. Below, we briefly explore the different entity options. 1.…

Creating a Positive Work Environment

Creating a Positive Work Environment “BEEP…BEEP…BEEP…BE-.” Hit the snooze on the alarm for the fifth time. Shower. Breakfast. Read the latest news headline on your iPad. Race off to work to begin another day in the cubicle. Since most people see their lives as highly repetitious, how do you create an environment where your employees…

Saving Lives Through Glycoproteomics | Aldo Carrascoso

Saving Lives Through Glycoproteomics | Aldo Carrascoso We hope you found this interview about “Saving Lives Through Glycoproteomics | Aldo Carrascoso” enjoyable. To receive our free newsletter, contact us here. Subscribe our YouTube Channel for more updates. This transcript was generated by software and may not accurately reflect exactly what was said. Alan Olsen, is the Host of…

Tips to Start Planning Next Year’s Tax Return

Tips to Start Planning Next Year’s Tax Return Source: IRS.gov For most taxpayers, the tax deadline has passed. But planning for next year can start now. The IRS reminds taxpayers that being organized and planning ahead can save time and money in 2014. Here are six things you can do now to make next April…