How Will the New President Change Taxes for the Wealthy?

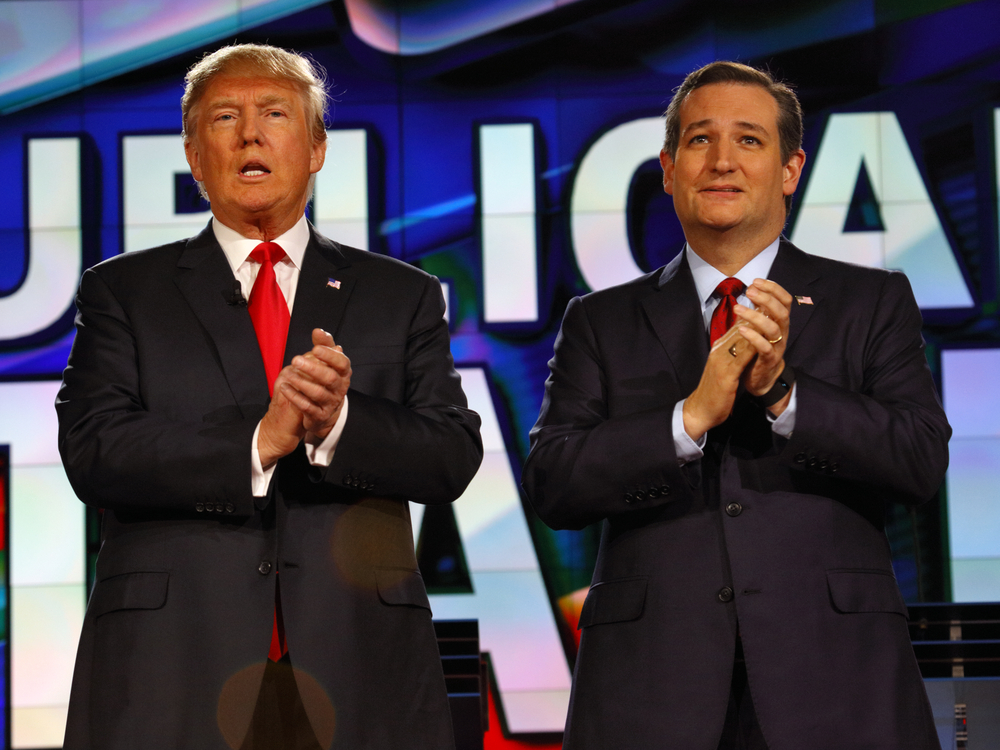

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Behavioral Finance: Beyond Greed and Fear

Behavioral Finance: Beyond Greed and Fear “Modern portfolio theory,” a complex mathematical system explaining the workings of the financial markets, has been quite influential on the thinking of investment managers over the last quarter century. The theory derives from the work of a handful of finance professors, several of whom were awarded Nobel Prizes for…

California Billionaires

California Billionaires March 10, 2006 Recent reports show that there are at least 100 new billionaires in the world this year, adding to the ever expanding list. Many billionaires reside in California, and are displayed below. Listings include rank, name, age where known, wealth in billions of dollars and source of the money. A number…

Mandatory e-pay for CA Taxpayers with +$80K of Tax Per Year

Mandatory e-pay for CA Taxpayers with +$80K of Tax Per Year Update: 11/10/09: The FTB now has a pay-by-phone option available. See: http://www.ftb.ca.gov/individuals/mandatory_epay/paybyphone.shtml That Franchise Tax Board (FTB) has begun mailing notices (FTB 4106 MEO) to taxpayers who meet the mandatory e-pay threshold. The new mandatory e-pay law requires taxpayers to remit their payments electronically…

Retire Your Mortgage Before You Retire

Retire Your Mortgage Before You Retire By George L. Duarte, MBA, CMC Broker, Horizon Financial Associates An increasing number of baby-boomer homeowners seem to be resigning themselves to the fact that, unlike their parents, they will be making mortgage payments well into retirement. If you look at statistics, you can see where this anxiety comes…