How Will the New President Change Taxes for the Wealthy?

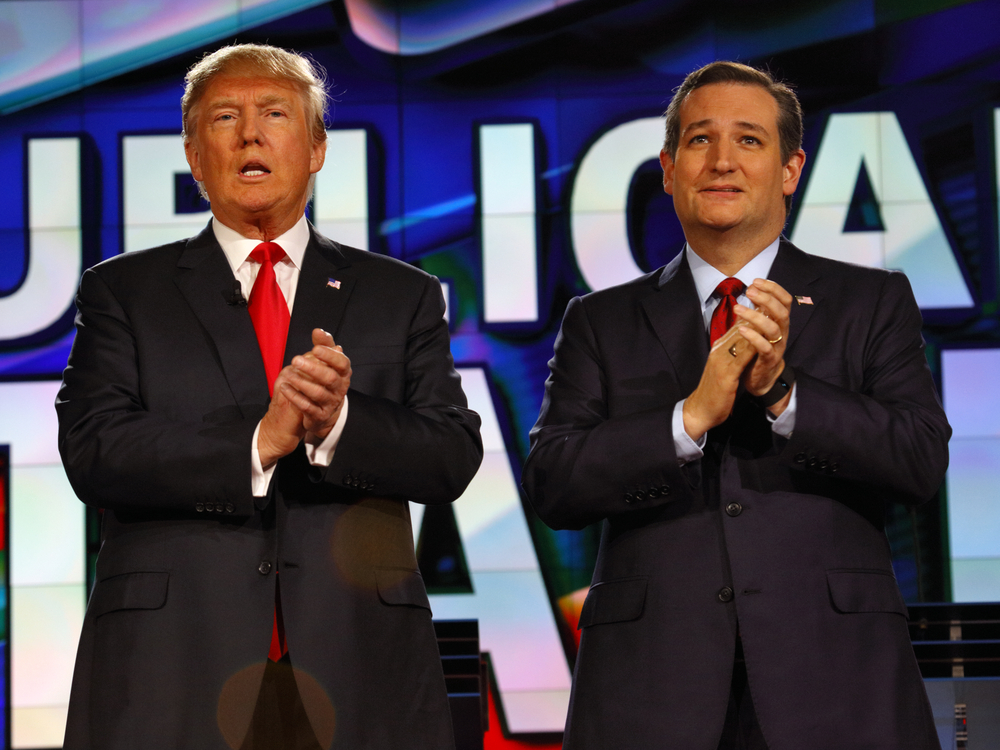

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

TechCrunch Disrupt SF 2016 Prov

TechCrunch Disrupt SF 2016 Prov Alan: Hi, this is Alan Olsen and I’m here today with the CEO, Toby Olshanetsky, and Alexey Sapozhnikov. They are the CEO and CTO of prooV. Welcome to today’s show. Toby: Thank you very much. Alexey: Thanks a lot. Alan: Okay, I’m gonna start with Toby. First of all, you’re…

TechCrunch Disrupt SF 2016- Rolik

TechCrunch Disrupt SF 2016- Rolik Alan: I’m here today with Sergei Gritsenko and he’s the co-founder of Rolik. Sergei, welcome to today’s show. Sergei: Thank you. Nice to meet you as well. Alan: So Sergei, tell me about your company. You currently are doing the world’s first digital video ad in the market place. Sergei:…

TechCrunch Disrupt SF 2016- SAP Hybris

TechCrunch Disrupt SF 2016- SAP Hybris Alan: Hi, this is Alan Olsen, and I’m here today with Samuel Schneider and he is with SAP Hybrid labs. Samuel, welcome to today’s show. Samuel: Hi, thanks. Yeah that was Hybris and Hybris is an SAP company and we are here offering our API market place. Alan: So…

TechCrunch Disrupt 2016- Spherica

TechCrunch Disrupt 2016- Spherica Alan: Hi, this is Alan Olsen. I’m here at TechCrunch and I’m here with Alina Mikhaleva she is the managing partner of a company called Spherica. Welcome to today’s show. Alina: Thank you so much. Thank you for having us. Alan: And also, this is Nick back here and Nick is…