How Will the New President Change Taxes for the Wealthy?

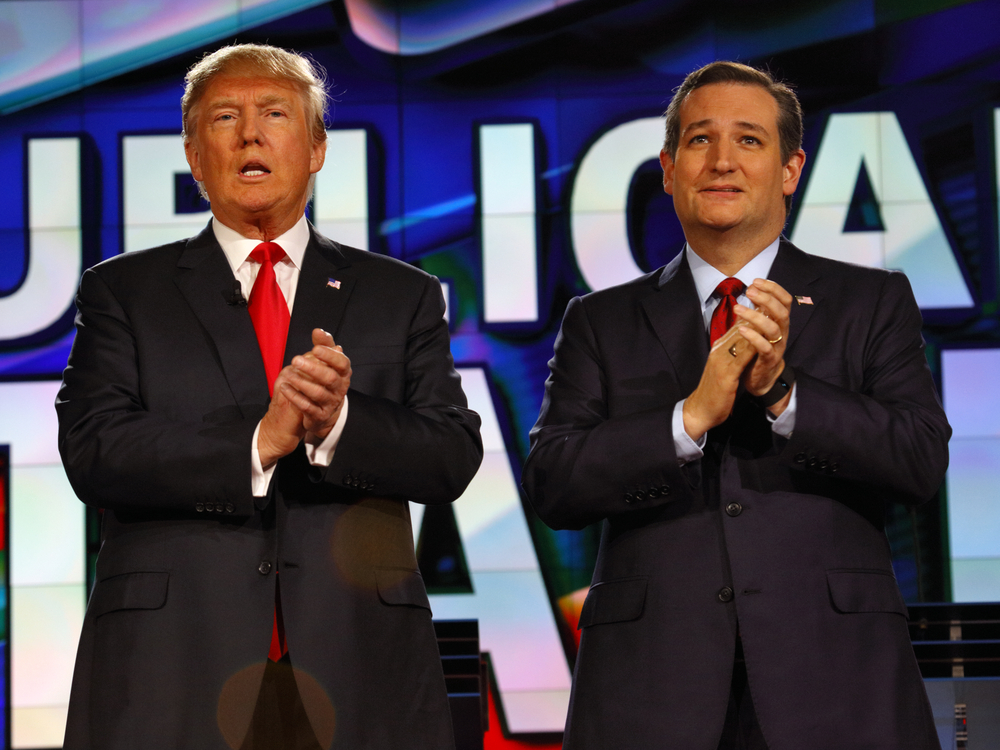

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

IRS Will Get its Share From Olympic Medalists, Too

IRS Will Get its Share From Olympic Medalists, Too If you’re like most people in the country, and many others around the world, then you’ve been watching the Summer Olympics over the last 10 days or so. After all, they only happen once every four years. There have been many exciting storylines, like Michael Phelps’s…

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon Despite all the wonderful products and groundbreaking technologies Apple has been responsible for over the years, the tech giant is certainly no stranger to criticism. That criticism comes in many forms, including from competitors and those who prefer competitors’ products. There are also…

Is Obama Secretly Trying to Raise the Death Tax Again?

Is Obama Secretly Trying to Raise the Death Tax Again? Democrats and Republicans have been battling over the estate, or death tax for decades. Democrats always push for a higher rate, while republicans would like to completely eliminate it. During the most recent Bush administration the death tax dropped from 55 percent to 45 percent…

Mark Cuban’s Take on Donald Trump’s Taxes

Mark Cuban’s Take on Donald Trump’s Taxes If you follow the presidential election then you know that this year’s run for the Oval Office is perhaps one of the most spite-filled elections our country has ever faced. According to many political pundits, talking heads in the media and dozens of poll results, the last two…