How Will the New President Change Taxes for the Wealthy?

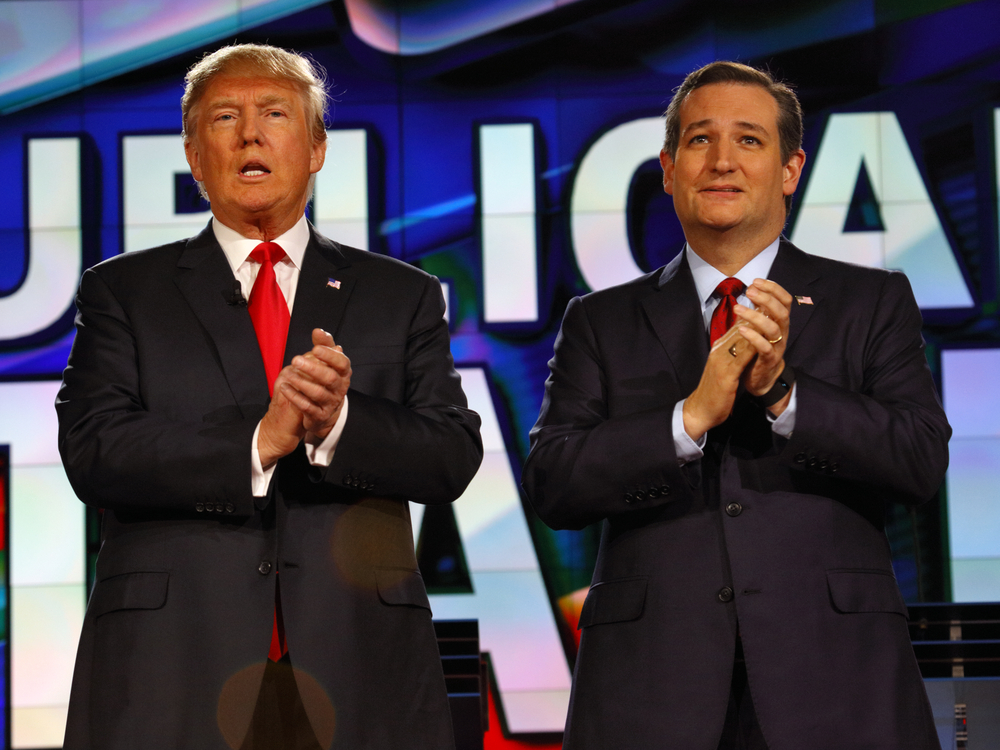

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

How Long Does it Really Take to Prepare Business Taxes?

How Long Does it Really Take to Prepare Business Taxes? For most people, just hearing the words business taxes is enough to cause uneasy feelings, but for business owners the thought of doing their own business taxes can be a nightmare. Filing individual tax returns can be hard enough but the process gets even more…

Tax Topics Business Owners Need to Know

Being the owner of a small business can be very rewarding, but very challenging at the same time. One of the biggest challenges small business owners face is dealing with taxes. There are countless items to keep track of and monitor with small business taxes, but these are some of the most important issues to…

Top Tax-Saving Moves Used By High Net Worth Individuals

One of the biggest complaints certain groups or individuals have against the wealthy is that they can take advantage of too many tax breaks and loopholes to lower their tax bill. So what are some of the top tax strategies that high net worth individuals use to keep their tax rates down, and could anyone…

Should University Donations Trigger Tax Breaks for the Wealthy?

Universities big and small receive donations from many different sources, including wealthy alumni. However, not all donations are created equal and because the wealthy donors get a huge tax break for their significant donations, some wonder if that is really fair. For example, Nike co-founder, Phil Knight, recently donated $400 million to Stanford, where he…