How Will the New President Change Taxes for the Wealthy?

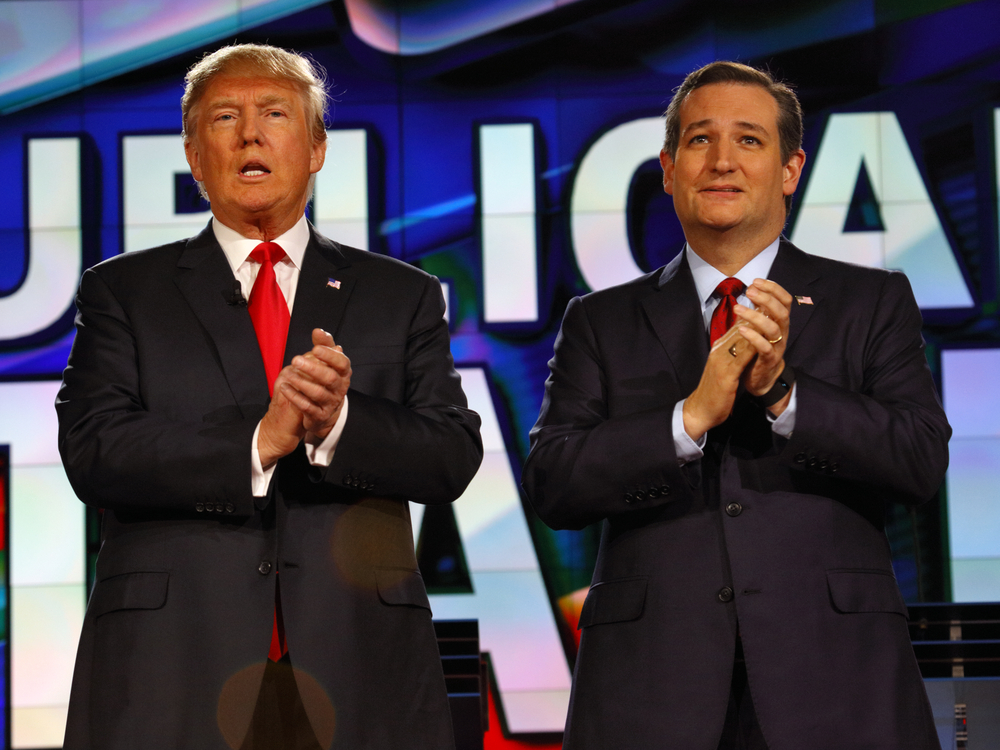

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Robert Wood – Founder of Wood LLP

Robert Wood, Founder of Wood LLP interview transcript: Alan Olsen: A lot of time Personal Injury Lawsuits are taken on a contingent fee basis. When a person is awarded great lawsuit settlement, oftentimes after the attorney takes their fee from the lawsuit settlement a the plaintiff gets a tax form in the mail saying they…

Is Philanthropy Good for Capitalism?

Is Philanthropy good for capitalism? In 2013 Zoltan J. Acs wrote the book Why Philanthropy matters. It explores the benefits of Philanthropy on the US economy; “…philanthropy as an underappreciated force in capitalism, measures its critical influence on the free-market system, and demonstrates how American philanthropy could serve as a model for the productive reinvestment…

George McGherin of The McGehrin Group

Transcript of George McGherin, of the McGherin Group, interview by Alan Olsen for the American Dreams Show: Alan Olsen: Welcome to today’s show I have with me, George. McGehrin George, welcome, George McGherin: Alan, it’s good to be here. It’s good to catch up with you. Alan Olsen: So, George, you’re a founder of the…

The Flip Transaction: Bringing Your Foreign Startup into the US Investment Market

By Roger Royse, Partner, Haynes Boone, LLP in Palo Alto, CA. The flip transaction, bringing your foreign startup into the US investment market. Non-US startups often arrive at the point where they wish to seek funding from a US venture capital firm or establish a presence in the US. Sophisticated investors tend to prefer to…