IRS Has Handed Out More Than $100 Billion in Refunds so far

As with every tax season there have been some mistakes that have caused problems for some taxpayers, as well as the usual battle with tax scams that pop up every year. However for the most part, the refund process has gone well to this point. In fact, at the end of February, the IRS reported that it had issued $125 billion and processed nearly 40 million tax returns. The average refund was reportedly $3,120.

Compared to last year, the IRs is only about .1 percent behind in the number of returns it has processed. As for refunds compared to the same time last year, the IRS has issued 1.1 percent fewer than in 2014. The average amount is up by $4, which individually isn’t much, but it’s a good sign for the country as a whole. The IRS says that so far about four out of every five returns has received a refund this year.

On the downside, that trend is not likely to continue, given that most of the early filers are typically expecting a refund. Those who expect to owe money often wait as long as they can before sending in their return. Overall, the nation’s top tax agency expects to process more than 150 million income tax returns before the tax season officially ends on April 15.

Still haven’t filed your return? It’s not too late. Contact GROCO today for help at 1-877-CPA-2006, or by clicking here.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

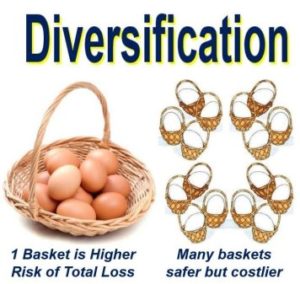

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

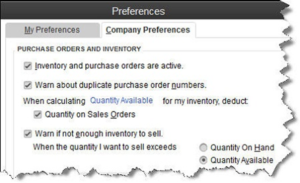

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…