Should the IRS File Your Taxes for You?

Imagine a world where you didn’t have to file your own taxes. Of course, you can use an experienced and professional tax and accounting firm like GROCO to do your taxes for you, but what if you didn’t even have to send your tax return information to an accountant? Could that ever really happen? In reality, probably not, but that isn’t stopping one U.S. senator from at least proposing the idea.

Democratic senator, Elizabeth Warren, from Massachusetts, has introduced the tax Filing Simplification Act of 2016. The senator hopes to “simplify and decrease the cost of the tax filing process for millions of American taxpayers.” Her proposal would actually force the IRS to come up with a preparation and filing service that all taxpayers could use for free to directly file their taxes with the government.

The service would require the IRS to fill in all the necessary information, which would come from W-2s and 1099s, which the agency already receives. Each taxpayer would then be responsible to make sure the information was correct. Some taxpayers that have very basic tax situations might not even have to file a return at all.

So what is the likelihood of this ever passing? Chances are the bill will not go anywhere, as Congress has always been reluctant to making these kinds of changes in the past. So while this might not ever become a reality, your tax accounting and tax preparation can still be stress-free. Just contact GROCO for help by clicking here or by calling 1-877-CPA-2006.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

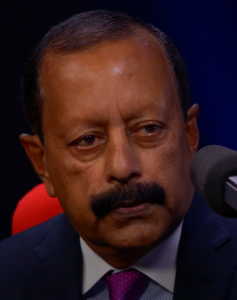

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…

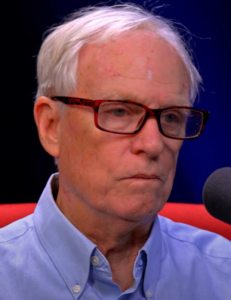

The Man Behind Morganstar Media | Randall Morgan

Interview transcript of Randall Morgan for the American Dreams Show, “The Man Behind Morganstar Media”: Alan Olsen: Can you tell us about your background and how you ended up working with Jane Goodall? Randall Morgan: I was a graduate student at Stanford, and had just finished my masters in documentary film, in walks Jane…