Tax Preparers Get Busted for Fraudulent Practices

Every tax season is full of stories and tales of people who go to great lengths to avoid paying taxes. In addition there are dozens of reports of unscrupulous tax preparers that get caught trying to cheat the system: either their clients or the IRS, or both.

We want to share a few of those stories with you, which come from Accountingtoday.com. The first tale comes from Latham, NY, where a 52-year-old tax professional has pleaded guilty to false returns. The preparer admitted to preparing 16 returns that contained all kinds of false information, from false deductions for unreimbursed employee expenses to energy efficiency credits. The false returns were submitted between 2008 and 2011. He could face as much as three years in prison and a fine of $100,000.

Elsewhere, the Justice Department has asked a federal judge to permanently bar three Liberty Tax Service franchises in South Carolina after they allegedly prepared false returns in order to give their clients’ refunds a boost. According to the complaint, one franchise filed returns that included a “bogus ‘arts and crafts’ business on one of its client’s return and a bogus ‘hair care’ businesses on another’s.”

Meanwhile, another preparer, in Louisiana, will be spending two years behind bars and another year of supervised release, along with paying a hefty fine of more than $225,000 after he was convicted of filing a false personal income tax return and preparing bogus returns for many of his clients.

These are just a few examples of dishonest tax preparers that are out there. So now that tax season is in full swing, make sure you choose a tax preparer you can trust.

IRS Will Get its Share From Olympic Medalists, Too

IRS Will Get its Share From Olympic Medalists, Too If you’re like most people in the country, and many others around the world, then you’ve been watching the Summer Olympics over the last 10 days or so. After all, they only happen once every four years. There have been many exciting storylines, like Michael Phelps’s…

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon Despite all the wonderful products and groundbreaking technologies Apple has been responsible for over the years, the tech giant is certainly no stranger to criticism. That criticism comes in many forms, including from competitors and those who prefer competitors’ products. There are also…

Is Obama Secretly Trying to Raise the Death Tax Again?

Is Obama Secretly Trying to Raise the Death Tax Again? Democrats and Republicans have been battling over the estate, or death tax for decades. Democrats always push for a higher rate, while republicans would like to completely eliminate it. During the most recent Bush administration the death tax dropped from 55 percent to 45 percent…

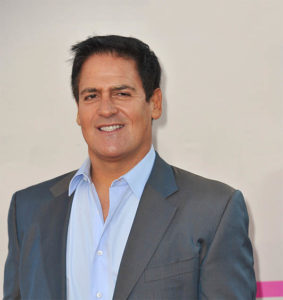

Mark Cuban’s Take on Donald Trump’s Taxes

Mark Cuban’s Take on Donald Trump’s Taxes If you follow the presidential election then you know that this year’s run for the Oval Office is perhaps one of the most spite-filled elections our country has ever faced. According to many political pundits, talking heads in the media and dozens of poll results, the last two…