Tax Season Got You Down? Blame Obamacare

What do you hate the most about taxes? Is it the simple fact that you have to file them? Is it the fear of being chosen for an audit? Is it all the confusing changes on tax laws and policies that drive you nuts? There are a lot of reasons people hate dealing with taxes, but this year, there could be a new number one reason for aggravation. Obamacare!

Although it’s actually called the Affordable Care Act, Obamacare, as most people know it, is sure to bring a lot of confusion and frustration this tax season. It will affect just about everyone in some way, but some more than others. Three aspects of your return in particular could feel the effects of Obamacare.

First and foremost, there is the individual penalty if you don’t have insurance. Here’s how the penalty works. If you don’t have insurance then you will pay the greater of the these two amounts:

- 1 percent of your annual household income, or

- $95 per person in the household for the entire year ($47.50 for those under 18).

Obamacare will also affect the Net Investment Income Tax, because as part of the plan there is a new 3.8 percent tax that will be added on to the capital gain rate. This 3.8 percent is applied to either the amount by which your adjusted gross income exceeds a certain tax threshold or to your net investment income; whichever is less.

Lastly, the Premium tax credit will also see the effects of Obamacare. Anyone who had health insurance via a Health Care Exchange could see the government subsidize his or her premiums.

So there you have it. Like it or not, Obamacare is probably going to affect you this year no matter what tax boat you’re in. Of course, we can help you get through the murky waters of the Affordable Health Care Act and ensure that you get the most from your return. Just call us at 1-877-CPA-2006 or click here.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

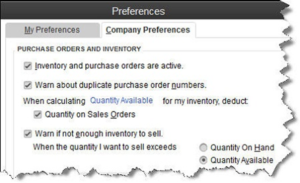

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…