Tax Season Starts Next Week – Are You Ready?

It’s almost here. That glorious time of year known and loved by millions as “tax season.” Of course, the reality is that most taxpayers don’t look forward to this time of year – unless they’re expecting a large return – but even those that fall into this category still don’t look forward to the tax filing process. In any case, love it or hate it, tax season is here. In fact, according to the IRS, the official tax filing season kicks off next week, on January 23 and runs through April 18.

There are some other filing notes to be aware of, as well. Anyone who e-files can submit their return before January 23rd; however, whichever software or online program you use will not actually submit them to the IRS until the 23rd. Additionally, anyone claiming the earned income credit or the additional child tax credit will not begin seeing their refund till Feb 23rd, due to a new law to protect against fraud.

So what can you do to start getting ready? First, there are several key forms that you should be looking for, including W-2s, 1099-Misc and 1099-Ks. These should all arrive by January 31. If you haven’t already begun gathering all your important tax and financial documents then now is the time to get started. If your taxes are complicated, or you’re a high net worth taxpayer then you should contact an experienced and qualified tax professional for help.

http://www.cnbc.com/2017/01/06/tax-season-opens-jan-23-heres-how-to-get-started.html

http://www.12news.com/money/irs-heres-when-you-can-begin-filing-your-2016-taxes/384371099

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

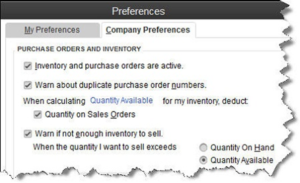

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…