The Skinny on Tax-Deferred Retirement Accounts

Just about anyone could benefit from a tax-differed retirement account. These accounts, most commonly known as 401Ks or IRAs, are a great way to save for retirement and in many cases save on taxes. The real question is when do you plan on cashing out that retirement fund? While you will always see immediate savings in your paycheck by deferring some of your income into a retirement account, the time will eventually come when the taxman comes calling.

However, there are some measures you can take to reduce your tax bill. You can convert your 401K plan, which could save you some money in retirement, rather than leaving the money in the tax-deferred account and withdrawing it later. If you do this then your funds will be taxed at the tax rate during the year you withdraw the funds. On the other hand, when you convert these accounts they will be taxed at the tax rate of the year you convert them. That means if this year’s tax rate will be lower than the normal tax rate when you are retired then now might be a good time to convert your funds to a Roth account.

Each person’s situation will vary and timing is the key to a successful conversion. There are also many variables to keep in mind, which is why it’s a good idea to speak with a certified account or experienced financial planner. At GROCO we can help you with your retirement planning to ensure that you get the most out of your retirement savings and keep your tax bill down. Just click here to contact us for help or call us at 1-877-CPA-2006.

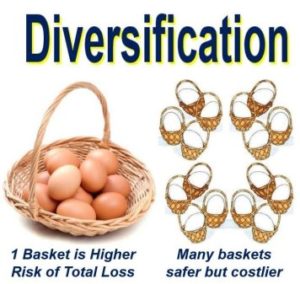

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

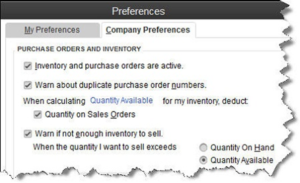

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…

Thinking About Giving up Your U.S. Citizenship? Think Twice

Thinking About Giving up Your U.S. Citizenship? Think Twice While not a lot of people ever entertain the thought of giving up their U.S. citizenship, there are more people every year that are making that choice. Among them are several wealthier people whose main reason for renouncing is to escape the country’s overloaded tax system;…