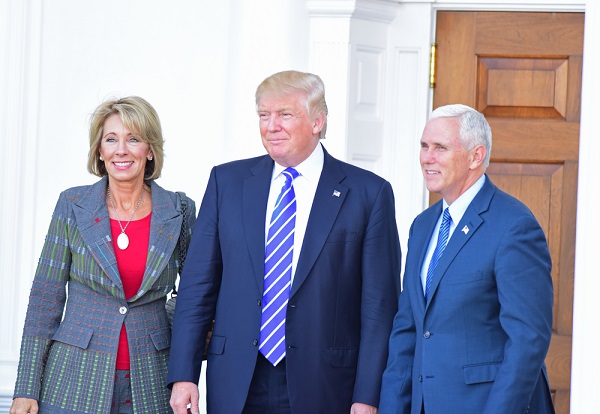

Trump Administration Proposes Sweeping Tax Cuts

After months of promises, a brutally combative campaign and election, and the first 100 days in office, President Donald Trump and his administration have released their tax plan, which promises to include “the biggest tax cut” in the history of our country, according to Treasury Secretary Steven Mnuchin and National Economic Council Director, Gary Cohn.

While the proposal does make big promises it did not include many specific details. For example, although the administration is promising to decrease the number of tax brackets to three, it did not reveal the planned income levels of those brackets. The plan also promises to change personal tax rates and eliminate many of the deductions that the nation’s wealthiest individuals use, but it was light on details.

On the other hand, some details were revealed, including the plan to greatly reduce corporate tax rate from the current level of 35 percent to just 15 percent. The plan also calls for allowing a pass-through rate for business owners, which would allow self-employed individuals to be taxed at the corporate tax rate instead of the personal income tax rate.

Meanwhile, even though the income levels for the three proposed tax brackets were not revealed the tax rates were: 35 percent, 25 percent and 10 percent. Some of the other significant proposals include:

- The elimination of the estate tax

- A one-time repatriation tax

- Standard individual tax deduction being doubled

- All itemized tax deductions being eliminated except mortgage payments and charitable donations

- Repeal the Net investment income tax of 3.8 percent

- Eliminate the alternative minimum tax

- Eliminate state and local tax deduction

http://www.businessinsider.com/trump-tax-reform-cut-plan-proposal-2017-4

http://thehill.com/policy/finance/330696-trump-proposes-sweeping-tax-reform

Tax Planning Strategies for the 3.8% Net Investment Income Tax

Tax Planning Strategies for the 3.8% Net Investment Income Tax Anyone who has any kind of investment income has probably wondered how tax laws will affect that income. Investment income can vary and the tax laws differ as well. As with many tax laws, how much investment income you actually make will play a big…

Startup Technology Is Not Enough to Start a Movement

Startup Technology Is Not Enough to Start a Movement How many great ideas for a startup companies do you know of that never really got off the ground? Startups are a dime a dozen and the majority never become successful. Even some of the best ideas and coolest technologies fail to reach their full potential. These…

World’s Most Expensive Gem Stones

World’s Most Expensive Gem Stones Anyone who appreciates fine jewelry is always on the lookout for that perfect piece to add to his or her collection. Whether you collect for a hobby or for business, or you simply love to wear jewelry and show it off to impress your friends, then you’ll want to be…

Some States Are Fighting Back Against New Tax Reform Law

Some States Are Fighting Back Against New Tax Reform Law By Alan Olsen It’s no secret that not everyone is happy with the nation’s new tax reform bill that was signed into law last December. Among those least pleased with the bill are taxpayers that live in high-tax states. In fact, several of these states…