Want to Avoid Taxes in Retirement – Try This

There’s been no shortage of thoughts and opinions regarding Donald Trump’s tax returns since the election process began, especially since his leaked return hit the mainstream media a few weeks ago. One could argue at length regarding those numbers and whether or not they paint a positive picture of Trump and his finances. However, there’s no question that Trump was able to use his losses to help offset gains in years to come.

This is just one of many tricks that the wealthy use to help reduce their taxes in retirement. There are several others that both the wealthy and the everyday average taxpayer can use to help offset their retirement tax bill. One of the most obvious is by using an employer retirement account, which helps offset taxes now and when you’re done working. In addition, you can open a Roth IRA, which is an excellent way to save after tax income. All Roth IRA withdrawals are tax-free once you’ve owned the account for five years and you are at least 59 ½ years old.

Having a health savings account is also a great way to save. The money you place in an HSA is pre-tax so you won’t get hit upfront and it’s tax-free when you withdraw it, as long as you use it for medical expenses. Given that most people experience more health problems in their retirement years than earlier in life, this is a great tax savings tip to save you money.

These are just a few of the ways to help save money on your retirement taxes, but there are several more, including using long term capital gains, your home equity and a charitable remainder trust. If you have more questions about tax savings in retirement then please contact GROCO today.

You also might like How to Save on Tax in Retirement

http://www.forbes.com/sites/financialfinesse/2016/10/09/how-to-be-like-trump-and-avoid-taxes-in-retirement/#7ee1313f5e95

IRS Will Get its Share From Olympic Medalists, Too

IRS Will Get its Share From Olympic Medalists, Too If you’re like most people in the country, and many others around the world, then you’ve been watching the Summer Olympics over the last 10 days or so. After all, they only happen once every four years. There have been many exciting storylines, like Michael Phelps’s…

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon

Apple Not Ready to Bring Foreign Income Back to U.S. Anytime Soon Despite all the wonderful products and groundbreaking technologies Apple has been responsible for over the years, the tech giant is certainly no stranger to criticism. That criticism comes in many forms, including from competitors and those who prefer competitors’ products. There are also…

Is Obama Secretly Trying to Raise the Death Tax Again?

Is Obama Secretly Trying to Raise the Death Tax Again? Democrats and Republicans have been battling over the estate, or death tax for decades. Democrats always push for a higher rate, while republicans would like to completely eliminate it. During the most recent Bush administration the death tax dropped from 55 percent to 45 percent…

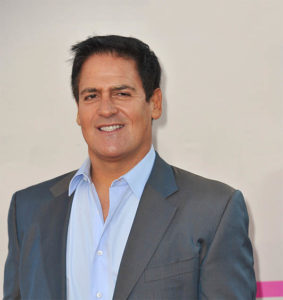

Mark Cuban’s Take on Donald Trump’s Taxes

Mark Cuban’s Take on Donald Trump’s Taxes If you follow the presidential election then you know that this year’s run for the Oval Office is perhaps one of the most spite-filled elections our country has ever faced. According to many political pundits, talking heads in the media and dozens of poll results, the last two…