Which Tax Breaks Help High Net Worth Taxpayers the Most?

It’s no secret that the United States government generally taxes high net worth individuals at a much higher clip than those in the lower- and middle-income brackets. However, despite that fact, there are still many provisions in the tax system, if used properly, can help wealthy earners save on their taxes. So what are some of the best breaks afforded to the wealthy?

High net worth individuals use several tax breaks to ease their tax burden, and most of them use the skill and experience of a trusted accounting firm to help them maximize the tax breaks available to them. For example, the wealthy often save a bundle on taxes because tax rates are smaller for qualified dividend income and long-term capital gains. In fact the capital gains tax is probably the biggest break the wealthy employ.

Another big tax break the wealthy receive is the “wage cap” on Social Security payroll tax. The government automatically deducts 6.2 percent from employees’ paychecks, but that is only applied to the first $118,500 someone earns. After that the wealthy don’t pay any more payroll taxes.

Lastly, the estate tax offers another way for the wealthy to reduce their tax bills. That’s because the lifetime exclusion has risen from $2 million in 2008 to $5.45 million currently. In addition, heirs will now also receive a step-up in basis on the assets they inherit.

So, while the nations’ wealthiest individuals do pay more in taxes than everyone else, there are some nice tax breaks available to them that can at least help reduce their bill. Contact GROCO to learn how we can help you hold onto more of your wealth. Call 1-877-CPA-2006.

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

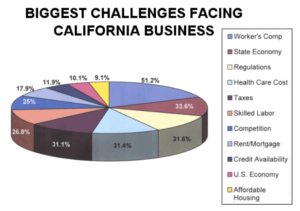

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…

15 Tips to Streamline Your Business and Become Profitable in 2007

15 Tips to Streamline Your Business and Become Profitable in 2007 By Julian Stone Here are some tips to help you ‘cut the fat’ and improve the productivity of your business. If you apply a few of these, you’re well on your way to achieving greater profit and creating less stress! Cut the SlackersCut the…