Will Illegal Immigrants Really Get A Huge Check From the IRS?

Whether you are for or against President Obama’s immigration plan, the fact that all the illegal immigrants in the country could file tax returns and claim refunds for the last three years, seems outrageous. However, according to the IRS, under the Earned Income Tax Credit, that is precisely what could happen. It doesn’t matter if a person has never even filed a return or reported any income.

Under the president’s plan an illegal immigrant could get a Social Security number, and then qualify for the Earned Income Credit for the last three years, thanks to a current IRS practice. That means even though someone who has only been in the country for a short time could actually claim money for three years just by acquiring a Social Security number and filing for the Earned Income Credit.

The country would literally be giving away billions of dollars in free money to people who are illegally living in the United States. However, according to reports, one U.S. lawmaker has already created a bill that would prevent undocumented workers from receiving this tax credit.

Representative Patrick McHenry is also concerned that the President’s actions could open the door to dozens of fraudulent returns and billions of dollars in lost tax revenue. He claims that any illegal worker in the U.S. that broke the law to get here should not receive benefits from the country’s tax system.

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

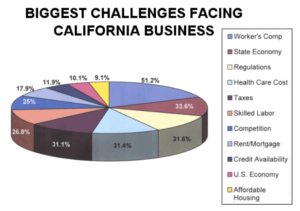

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…