Will Your Tax Return Draw the IRS’s Attention?

No one wants to experience a tax audit. The good news is that most people never will have to go through that experience. The IRS simply doesn’t have the time and resources to audit every tax return. In fact, the IRS only audits about 1 percent of all returns. That means most people don’t have to worry about being audited. However, if you want to be extra careful and decrease your odds off being chosen even more, there are some tips to keep in mind when you file your tax return.

There are some red flags that could increase your chances of catching the IRS’s all-searching eye. Here are a few of them:

- You make a lot of money

- Your deductions are higher than normal

- Your charitable deductions are high

- You don’t report all taxable income

- You own or run a small business

- You claim the alimony deduction

- You claim a loss for a hobby

- You claim rental loss

- You deduct a lot of business expenses: travel, entertainment and meals

- You don’t report a foreign business account

- You cash out some of your 401k or IRA early

- You claim large gambling losses or don’t report big winnings

These are some of the most common ways to get the IRS’s attention, but if you avoid these kinds of things you might reduce your chance of an audit.

However, there is no full-proof way to avoid an audit, but keep this in mind: as long as you are being honest on your taxes you don’t have anything to worry about. Even if you are selected for an audit you will come out unscathed if you have nothing to hide. Another thing that can help is to contact a professional tax preparer to do your taxes for you. This will decrease errors and your chances of being selected for an audit. Contact GROCO if you need help with your taxes. Call 1-877-CPA-2006, or click here.

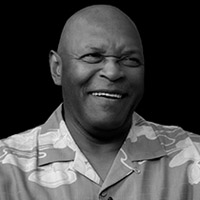

Beyond Baseball | Vida Blue

About Vida Blue Six time All Star, 3 time world series champion, MVP and Cy Young Award winner Vida Blue is quite a Baseball legend. Listen to his first hand experiences of what it’s like to play professional baseball and what’s the legend doing today? Interview Transcript: Alan Welcome back. I’m here today…

Disrupting The Aerospace Defense Industry with Additive Manufacturing | Kenneth Epstein

About Kenneth Epstein Ken is a principal with NewCap Partners & brings 20+years of investment banking & venture management experience, including P&L responsibility for both major business units and startups. His diverse client base includes private & family-owned businesses, strategic equity investors, large corporate venture funds, & material, high-tech & life science firms. Ken’s transaction…

The Science of Change Management | Gary Boomer

About Gary Boomer L. Gary Boomer is the Visionary & Strategist of Boomer Consulting, Inc., an organization that provides consulting services and peer communities to leading accounting firms. BCI’s vision is to make you more successful and future ready. The areas of focus are: Planning, People and Processes with technology as the accelerator. Gary is…

Predicting Success | Mike Kwantinetz

About Mike Kwatinetz Mike Kwatinetz is a founding General Partner with Azure Capital Partners where he specializes in software and related infrastructure technologies. His current board memberships are Chairish, Education.com, Julep, JumpStart, Le Tote, Medsphere, Open Road and Silkroad and he led Azure’s investment in FilterEasy, Maker Media, Coffee Meets Bagel, Sprinklr and Tripping. He…