Athletes Could See Big Tax Savings With Trump Proposals

It’s no secret that Donald Trump’s proposed tax plans would definitely benefit the nations’ wealthiest individuals. The president elect has made it clear he wants to overhaul our country’s tax system and his stated proposals indicate that the wealthy will see a healthy increase in the amount of money they get to keep.

Among the wealthy that will likely be saving a lot of money are professional athletes. Of course, almost all professional athletes make a very comfortable living, but certain of the top athletes in their given sports really stand to benefit from having Trump in the White House. First off, a large percentage of all professional athletes currently fall into the top tax bracket, which is more than 40 percent after adding the ACA net investment income tax of 3.8 percent. Under Trump that percentage would fall to 33 percent.

Here’s just one example of how much one star athlete could save thanks to the new president’s tax plans. Cleveland Cavaliers star LeBron James has a three-year $99 million deal. That means he would save an estimated $2.3 million every year on his salary alone. Add to that the savings he would receive on his endorsement earnings, which would be about $13.8 million a year, and James is likely to save more than $16 million annually in taxes.

There is a downside, as Trump has also proposed capping itemized deductions at $200,000, which means anything over that amount, which is entirely possible for James, he would not be able to deduct, thus reducing his total deductions amount. However, he would still likely have a total savings in excess of $15 million. James might have endorsed Hillary Clinton, but he will save more money with Trump.

http://www.forbes.com/sites/kurtbadenhausen/2016/11/10/trump-tax-plan-could-save-lebron-james-over-15-million-per-year/#731ad3552339

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

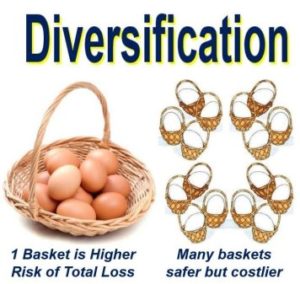

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

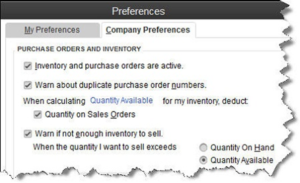

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…