How To Determine If Your Social Security Retirement Benefits Are Taxed

How To Determine If Your Social Security Retirement Benefits Are Taxed

By Robert Cavanaugh

Up to 85% of your Social Security retirement benefits may be taxable. Here’s how to find out how much is taxable and what you can do to reduce or eliminate any tax.

Of all the financial issues surrounding being a senior, the one that tops the list in terms of anger is the fact that, depending on the situation, Social Security retirement benefits are taxable. My experience indicates that some seniors are completely unaware of this fact. I have also had to sit and listen to the ranting of those who are aware. It goes something like this: “I already paid tax on the earnings during my working years. The Social Security withdrawn from my income each pay check was a tax. This sounds like a tax on a tax.” And on and on…

After letting the person blow off some steam, my response typically was, “Hey, don’t shoot the messenger! I’m here to see if any of your Social Security benefits are taxed, if so, how much and what we can do to reduce or eliminate that tax.” So let me take you through the first part of our conversation.

Whether or not you are taxed depends on:

- The amount of your income.

- Whether or not you have income from sources other than Social Security.

The amount of your tax depends on:

- Your marital filing status: single or married.

- The amount of your income.

The tax on Social Security retirement benefits was put into effect in 1983. Tax was applied on up to 50% of benefits. In 1993 this was increased to 85%. Here’s how the calculation goes…

The first step is to calculate your “provisional income”. So grab last year’s tax return.

- Subtract your taxable S.S. benefits (line 20b) from your Adjust Gross Income (line 37).

- Add one half of your total S.S. benefits (line 20a).

- Add any tax exempt interest (line 8b).

- The result is your “provisional income”.

Once you know this number, you can apply the rules to determine how much of your S.S. is taxed. Again, this depends on whether you are married or single and the amount of your income.

Let’s look first at a married couple filing jointly. Here is the math…

- If your provisional income is below $32,000, you don’t have a problem.

- For provisional income over $32,000:

a. Take the provisional income between $32,000 and $44,000 and divide it by two.

b. If your provisional income is above $44,000, take the total provisional income, subtract $44,000 and multiply by 0.85.

c. Add 2a and 2b.

d. Multiply your total S.S. benefits (line 20a) by 0.85.

e. The lesser of your result on 2c and 2e above is the amount of your S.S. benefit taxed.

Now let’s look at the calculation for a single person…

1. If your provisional income is below $25,000, none of your S.S. benefits are taxable.

2. For provisional incomes over $25,000:

a. Take the provisional income between $34,000 and $25,000 and divide it by two.

b. If your provisional income is above $34,000, subtract $34,000 from your total provisional income and multiply by 0.85.

c. Add 2a and 2b.

d. Multiply your total S.S. benefit (line 20) by 0.85.

e. The lesser of your result on 2c and 2d above is the amount of your S.S. benefit taxed.

Now that you know whether or not any of your Social Security benefits are taxable, and if so, how much, the next step is to take a look at the ways you can reduce or eliminate this tax. In general, there are three solution categories:

- Reduce your interest income. The most common is interest on CDs.

- Reduce your dividend income.

- Reduce your tax exempt interest income.

Note: The calculations above use a very simplified approach. Your situation may have other factors that would affect the math. It is strongly advised that you consult with a qualified tax professional.

We hope you found this article about “How To Determine If Your Social Security Retirement Benefits Are Taxed” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business. Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most. They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges. Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

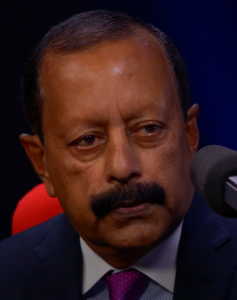

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…