Why I Didn’t Accept Venture Capital

Venture Capital Financing: Structure and Pricing

“Financing a venture can be structured using one or more of several types of securities ranging from straight debt to common stock.”

- Introduction

- Types of Securities

- Disadvantages of Debt to a Company

- Advantages of Debt to a Venture Capitalist

- Percentage Ownership Needed

- Case Studies

- Conclusion

Introduction

A venture financing can be structured using one or more of several types of securities ranging from straight debt-to-debt with equity features (e.g., convertible debt or debt with warrants) to common stock. Each type of security offers certain advantages and disadvantages to both the entrepreneur and the investor. The characteristcs of your situation and current market forces will impact the type and mix of security package that is right for you.

Types of Securities

- Senior debt: Which is usually for long-term financing for high-risk companies or special situations such as bridge financing. Bridge financing is designed as temporary financing in cases where the company has obtained a commitment for financing at a future date, which funds will be used to retire the debt. It is used in construction, acquisitions, anticipation of a public sale of securities, etc.

- Subordinated debt: Which is subordinated to financing from other financial institutions, and is usually convertible to common stock or accompanied by warrants to purchase common stock. Senior lenders consider subordinated debt as equity. This increases the amount of funds that can be borrowed, thus allowing greater leverage.

- Preferred stock: Which is usually convertible to common stock. The venture’s cash flow is helped because no fixed loan or interest payments need to be made unless the preferred stock is redeemable or dividends are mandatory. Preferred stock improves the company’s debt to equity ratio. The disadvantage is that dividends are not tax deductible.

- Common stock: Which is usually the most expensive in terms of the percent of ownership given to the venture capitalist. However, sale of common stock may be the only feasible alternative if cash flow and collateral limits the amount of debt the company can carry.While each of these securities has unique characteristics, they can be grouped into two categories: debt or equity. In structuring a venture financing, the primary question is whether the financing should be in the form of debt or equity.

Disadvantages of Debt to a Company

From a company’s viewpoint, there are two potential disadvantages to debt.

- An excessive amount of debt can strain a company’s credit standing, thereby reducing its flexibility in meeting future long-term financing requirements on a favorable basis. It can also negatively affect a company’s ability to obtain short-term credit. Of course, the form of debt the venture financing takes makes a difference. For example, subordinated debt will have less impact on borrowing capacity than senior debt.

- The venture capitalist has the option of calling his loan if the company is in default of the loan agreement. This remedy, which is not available to him under other financing agreements, puts him in a better position to influence the company’s affairs when it is in default.

Advantages of Debt to a Venture Capitalist

From the venture capitalist’s viewpoint, there are three principal advantages to debt.

- There is a greater likelihood that the venture capitalist will get his principal back and, at least, a small return. Many of the companies in the average venture capitalist’s portfolio are referred to as “the living dead.” Needless to say, their performance has turned out to be disappointing. In some cases, these companies are able to repay principal with interest but have limited appeal to potential acquirers or the public. As a result, a venture capitalist with an investment in such a company’s common stock may be unable to recover his investment within a reasonable period, if at all.

- As previously discussed, under certain circumstances the venture capitalist is in a better position to influence the company’s affairs.

- The venture capitalist has a senior claim. However, it should be emphasized that the meaningfulness of a senior claim depends on the marketability of a company’s assets and the amount of equity it has to cushion its creditors’ position. For example, in the case of a start-Lip situation with little or no equity, a senior claim means little or nothing.

Percentage Ownership Needed

While the difference may not be great, depending on the particular circumstances of the company, a debt position involves less risk than an equity position for the venture capitalist. Accordingly, a company should not have to relinquish as much ownership when a financing is in the form of debt. However, this advantage must be weighed against the disadvantages of debt.

No matter how the venture financing is structured, it must be priced so that it is attractive to the venture capitalist. There is no clear-cut answer as to how much ownership a company will have to relinquish to make a financing attractive. Broadly speaking, the greater the potential return perceived by the venture capitalist, the less ownership he will demand. In other words, if a company has a patented product which a venture capitalist thinks is revolutionary and highly marketable, he will undoubtedly settle for less ownership than he would in the case of 4 company with a relatively less attractive product. Thus, his ultimate position will be a business judgment based on his potential return.

Before you enter negotiations with the venture capitalist, you should determine what your company is worth and how much of your company you want to sell. The following procedure can be used to get a rough idea of how much ownership you will have to give up to make the financing attractive.

- Estimate the risk associated with the venture financing. If the investment is very risky, the venture capitalist may be looking for a return as high as 15 times his investment over five years. Conversely, if a relatively low degree of risk is involved, the venture capitalist may be satisfied with doubling or tripling his investment over five years.

- Make a reasonable estimate of the price/earnings ratio applicable to comparable publicly held companies. The market value of the company can then be projected by multiplying forecasted annual earnings by the estimated price/earnings ratio for comparable companies.

- Divide the estimate of the total dollar return the venture capitalist wants by the projected market value of the company. This yields the percentage ownership the venture capitalist will need, as oil the future date, to realize his desired return. It is important to note that any equity financing required during the interim period must be considered in making these calculations.

Case Study

Suppose XYZ Company, Inc., a start-up, needs $500,000. The company’s product appears to have excellent potential. However, because the product is new and unproven, an investment in the company would be extremely risky. Accordingly, it is reasonable to estimate that a venture capitalist would want a potential return of at least ten times his total investment in five years. Management estimates that the company should be able to “go public” at 20 times earnings in five years. Projected after-tax earnings for the fifth year is $1,250,000. Additional long-term financing of $500,000 will be needed at the beginning of the third year.

Scenario I

In the calculations below it is assumed that the venture capitalist who provides the initial financing ($500,000) also provides the subsequent financing ($500,000), and that he wants a return equal to ten times both. However, it should be noted that if the company made satisfactory progress during the first two years, it would be reasonable to assume that the venture capitalist would be satisfied with a lower return on the subsequent financing since it would involve less risk.

| Estimate of Total Dollar Return Required | |

| Total Investment | $ 1,000,000 |

| Estimate of Return Required | X 10 |

| $10,000,000 | |

| V. Projected Market Value in Fifth Year | |

| VI. | |

| VII. Projected Earnings | $1,250,000 |

| VIII. Estimate of P/E Ratio | x 20 |

| $25,000,000 | |

| Percentage Ownership Needed in Fifth Year | |

| Estimate of Total Dollar Return quired | $10,000,000 |

| Projected Market Value of Company in Fifth Year | 25,000,000 |

| 40% | |

Scenario II

In this set of calculations it is assumed that a second investor provides the subsequent financing ($500,000). The calculations show that the venture capitalist who provides the initial financing ($500,000) would need 20% ownership as of the fifth Year to realize the return he wants. However, since the ownership to be given up for the subsequent financing will reduce his ownership position, he will want more than 20% ownership initially. For example, if it is assumed that 15% ownership will have to be given up for the subsequent financing, the venture capitalist who provides the initial financing would need 23% ownership initially to end up with 20% ownership in the fifth year.

Assume the same facts as Case I, except a second investor provides the subsequent financing for 15% ownership.

| Estimate of Total Dollar Return Required | |

| Total Investment | $ 500,000 |

| Estimate of Return Required | X 10 |

| $5,000,000 | |

| Projected Market Value in Fifth Year | |

| Projected Earnings | $1,250,000 |

| Estimate of P/E Ratio | x 20 |

| $25,000,000 | |

| Percentage Ownership Needed in Fifth Year | |

| Estimate of Total Dollar Return required | $5,000,000 |

| Projected Market Value of Company in Fifth Year | 25,000,000 |

| 20% | |

Thus, it appears that the investment ($500,000) may be attractive to an interested venture capitalist if the principals of XYZ Company, Inc. are willing to give up approximately 23% ownership.

Conclusion

It must be emphasized that the above procedure is highly subjective. And, you should remember that what really matters is how the venture capitalist views the relative attractiveness of a company. Typically, venture capitalists are satisfied with a minority interest. Although a venture capitalist may demand a majority interest, generally they are not interested in operating control. Some of them like to tie the amount of ownership they ultimately get to the performance of the company. For example, a venture capitalist who wants a majority interest initially may give the principals the opportunity to earn part of it back. Such an arrangement can be used to compromise on pricing when there is a significant disagreement between the principals and the venture capitalist.

To entrepreneurs unfamiliar with venture capital, it may appear that the venture capitalist is seeking an extraordinary high return on his investment. However, it is important to understand that, even under the best of circumstances, only a minority of the companies in which the venture capitalists invests will be successful. He is well aware of this, and must make a sufficient return of his successful investments to come out with an acceptable return overall.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

This transcript was generated by software and may not accurately reflect exactly what was said.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more.

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. I’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

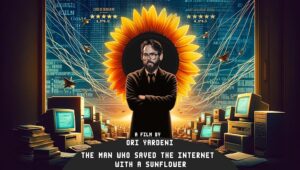

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…

Early Detection Saves Lives with Steve Marler

Steve Marler, Founder of Advanced Longevity discusses how early detection can save lives and overcoming a broken healthcare system on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to American Dreams. My guest today is Steve Marler. Steve, welcome to the show. Steve Marler Thank you. It’s great to be here. Alan Olsen So Steve,…