Could You Claim a Tax Credit for Your Nanny?

Could You Claim a Tax Credit for Your Nanny?

Although tax laws have certainly changed under the Tax Cut and Jobs Act, there are still numerous tax credits available. Some of these credits are obvious. But there are several you might be overlooking.

For example, did you hire or use a nanny throughout the year? Many high net worth individuals with kids employ nannies. If you’re one of them, then you could be eligible for the child and dependent care tax credit. With this credit you could qualify for as much as $1,050 for a child younger than 13. If you have more than one child, that number rises to $2,100.

However, be aware, if you’re hoping to qualify for this credit then everything has to be “on the level.” In other words, you must pay your nanny legally, as an employee, and remit the necessary employment taxes. If you’re paying your nanny under the table, then you won’t be able to qualify for this credit.

In order to be in compliance with the IRS, and be eligible to claim this credit, there are a few things you must do. You need to fill out a Form I-9, a Form W-4 and a Schedule H.

A Form I-9 is used to verify the identity and employment authorization of your nanny. A Form W-4 allows you to withhold federal income from your nanny. And a Schedule H shows how much you paid your nanny. It also shows how much you spent in applicable Medicare and social security taxes, and unemployment.

Once you have everything in order, you will likely qualify for the credit.

We hope you found this article about “Could You Claim a Tax Credit for Your Nanny?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

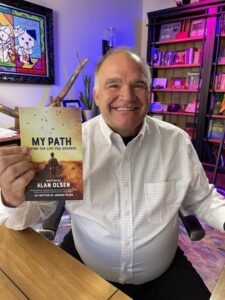

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…