Critical Decisions When Launching a Startup

There are countless aspects to launching a startup company. To do it successfully a founder has to make many critical decisions and be right on most of them. Many entrepreneurs have a great idea or product with great plans to make it successful. However, they don’t make the right business decisions, which leads to their startup either failing or never even getting off the ground. When you are ready to launch a startup you have to make sure that you have the right people in place who can help you succeed.

Put the Right People in the Right Positions

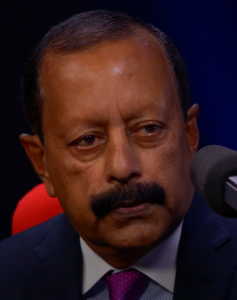

I recently spent some time with Montgomery (Monty) Kersten, who is an angel investor and Independent Board member of several startups. We discussed many different key aspects of startup companies and Monty shared with me some of his advice for startups that he’s gained over the years as he’s participated in the successful launch of many startups in Silicon Valley and elsewhere, “Gather around you people who have done it before and put them on the advisory board”. Instead of making them full-time employees. “Listen to their experience and wisdom because many times your early investors will be advisory board members who can help you, guide you and be supportive of you when things go wrong.”

Founder Must Be the Driving Force

Monty reiterated the importance of hiring the right people and building the right advisory board: “Never let down the bar in hiring. Only hire world class people who are willing to work as hard as you.” He added to compensate them fairly. Monty also noted how important it is for a founder to be the one who drives the company forward with a vision and a concrete achievable plan.

Building Your Board of Directors

I asked him how he recommends going about building your board of directors and how to stay in control of your company. He said the reason he is often asked to become an independent board member is because he was a successful CEO and because he serves as an independent board member and not as a representative of a venture capital firm. That’s because the founder typically wants operations advice that is for the benefit of the company.

Consider Your Best Long-Term Interests

On the other hand, venture capital firms are most interested in their own investment as board members, which is how some founders lose control of their companies. “As you build your board, you will find that the dirty secret of Silicon Valley is two out of three founders are replaced by their board of directors over the lifecycle of the company.” So in order to stay in control of your company, it’s important to build your advisory board with several independent board members instead of mostly venture capital firms.

To view the full interview with Monty please click here.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…