Could This Be the End to an American Icon in the U.S.?

Could This Be the End to an American Icon in the U.S.?

Samuel Adams was one of our great Country’s founding fathers and an American statesman. However, despite his political accolades and contributions to the United States, his name might be better known as a brand of beer. That right; if you asked who Sam Adams is, many people would better identify the name with one of the many brands of beers made by east coast brewer the Boston Beer Company. So what would one of our country’s original founders think if he heard that the beer company most famous for his name could possibly be considering making a move to foreign land? While the very thought could cause him to turn over in his grave, that possibility could become a reality at some point in the future, thanks to the country’s antiquated corporate tax system.

The Buyers Are Coming, The Buyers Are Coming

According to Jim Koch, the company’s founder, while he is not planning a move anytime soon, he fears that it will only be a matter of time before the brewing company packs up and heads to foreign soil; most likely via a purchase by a foreign beer maker. In fact, Koch recently told a senate committee that he would probably be the last American owner of the Boston Beer Company. The reason, according to Koch, is his company would be worth a lot more to a foreign owner than it is to someone who lives under the guise of the broken U.S. corporate tax structure. While Koch is still loyal to his country, he also said he receives pitches from potential buyers to purchase his company regularly.

Broken System Not Getting Better

The reason Koch was in front of the senate committee in the first place was because lawmakers wanted to discuss the tax rules that are currently in place that would serve as fuel for companies to consider either moving their headquarters overseas or selling them to a foreign buyer. America is well known for taxing corporations harshly, which puts many companies at a disadvantage. It’s also why so many companies pack up and move, or eventually sell out. The U.S. would like to put a stop to this practice, but until it fixes the corporate tax structure the practice will continue. The reasons are obvious.

The Numbers Don’t Lie

It’s all in the numbers. Take Boston Beer Company for example. The brewing company recently reported its second quarter earnings, which included about $47 million of pretax income. Every dollar of pretax earnings is worth 62 cents to the company. However, if a foreign company or investor owned it, every pretax dollar would be worth 72 cents. That’s a significant difference. So while the company remains on American soil for now, unless lawmakers change the current corporate tax structure in the U.S., then Sam Adams could soon be looking for new territory to call home. That could leave one of America’s revolutionary heroes in a peculiar situation.

—————————————————————————————————————————————————————————————————————

We hope you found this article about “Could This Be the End to an American Icon in the U.S.?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Introducing the “Total Return” Trust

Introducing the “Total Return” Trust The fundamental purpose of most trusts is to create a plan of financial protection for more than one beneficiary, often beneficiaries in different generations. “All the trust income to my surviving spouse, with the balance to be divided among our children at her death” might be used in a marital…

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

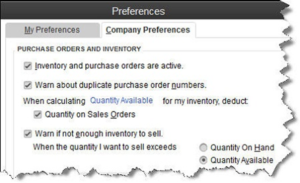

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…