Myths About Trusts

Myths About Trusts

Trusts are a dependable way to arrange for the management of family funds. Yet even financially sophisticated people settle for less satisfactory alternatives. Lack of knowledge isn’t the problem.

It’s the assorted myths about trusts handed down over the years.

Myth #1. Only the very rich use trusts.

Because what the superrich do is by definition “news,” media reports inadvertently encourage the misconception that trusts are only for the very rich. The fact is, the great majority of people who set up trusts are affluent, not superwealthy. Typically, they are people who seek sound financial management for money received from the sale of property or a business, for invested funds built up over their lifetimes, for inheritances or life insurance proceeds, or for payouts from pension plans.

Myth #2. Trusts are arrangements made for heirs, not for yourself.

Although some trusts continue to be created by will, today many men and women create living trusts. A living trust is simply a trust that a person sets up during his or her lifetime, and typically the creator of the trust is also the primary beneficiary. (Look at it this way: Eager though you may be to provide financial support for your family, shouldn’t you start by providing it for yourself?)

Agewise, a person who sets up a living trust usually turns out to be somewhere between 45 and 65.

Myth #3. When you put funds in trust, it’s like locking up your money and throwing away the key.

Fact: A trust fund can be as accessible or as “locked up” as you care to make it. If you’re setting up a trust primarily for your own benefit, you’ll want everything accessible. You may also want to give your spouse or child access to trust assets.

Sometimes, though, it’s desirable to impose certain controls. For instance, when widows or widowers with children remarry, and set up trusts for themselves and their new spouse, often they “lock things up” just enough to ensure that the trust assets ultimately pass to their own children, not their spouse’s.

Myth #4. Trusts are too complicated.

Again, the provisions of a trust can be as simple or as complicated as you want them to be. The basic terms of a living trust are usually simple. A widow, for instance, directs the trustee to invest her assets, pay her the income for the rest of her life (plus any amounts that she wishes to withdraw from time to time), and then wind up the trust by dividing what’s left among her children.

But a little extra planning can be well worth the resulting “complexity.” The woman just mentioned might want to expand the terms of her trust to allow the trustee to act for her in financial matters if she becomes incapacitated. The trustee can pay her medical expenses, taxes, household bills and other recurring expenses from the trust if she is no longer able to handle these chores herself.

Myth #5. Trust services are expensive.

Fees will depend upon the duties that you ask your trustee to perform and the size of your trust fund. Generally, these charges are competitive with what you would pay elsewhere for top-quality investment management. In some cases they even may be lower.

Myth #6. Trusts don’t provide good investment performance.

You may have heard that trust funds are invested conservatively, resulting in subpar rates of return. But in actuality banks and trust companies have an enviable record of providing consistently productive investment performance.

Myth #7. Trust services are impersonal.

Admittedly, the personal touch is much less in evidence in today’s world of automated, computerized “financial services.” Personal trust service is a dramatic exception to the trend.

To be sure, high-tech computers help keep records, compare possible investments and analyze personal planning options. But such operations are “behind the scenes.” When you place your assets in trust, you deal directly with a trust officer who will take the time to get to know you.

Once people get past the myths, they usually become fascinated by the remarkably practical ways in which they can use trusts to build financial security. A meeting with a trust officer will allow you to explore the many ways that you can benefit from a trust.

We hope you found this article about “Myths About Trusts” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Unveiling Entrepreneurial Success with Randi Brill

Randi Brill, best-selling author and CCO of Just Call Randi Design Agency discusses unveiling entrepreneurial success on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Randy brill. Ready welcome to today’s show. Randi Brill Thank you, Alan. I’m glad to be here. …

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

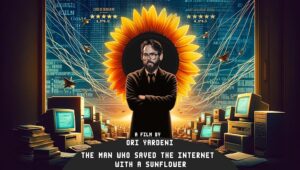

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…