When Not to Name Your Spouse the Beneficiary of Your IRA

When Not to Name Your Spouse the Beneficiary of Your IRA

By Robert Cavanaugh

In most cases, naming your spouse as the beneficiary of your IRA makes the most sense. However, depending on your wishes, other beneficiary arrangements may do a better job of accomplishing your goals.

First, let’s take a quick look at the requirements and advantages of naming your spouse as the sole beneficiary of your IRA. Choosing another beneficiary will cause you to lose some of these advantages.

The first advantage allows the spouse to elect to treat the IRA as his or her own. When the objective is to delay the required minimum distributions (RMDs) for as long as possible, the spouse would generally elect this option. This election allows the spouse to postpone RMDs until they reach age 70 1/2 in the case of a traditional IRA or SEP. RMDs are deferred all the way to the death of the spouse if the IRA were a Roth. If the spouse is younger than the deceased IRA owner, this makes a lot of sense where deferral is desired.

Using the life expectancy of the spouse and a beneficiary is one of the spouse’s options, thus potentially extending the payout period. If the spouse were not the sole beneficiary, the life expectancy of the IRA owner and beneficiary is the requirement. Given the fact that the IRA owner is older, this shortens the distribution period.

If the IRA owner dies before age 70 1/2, the spouse can defer the RMDs until the IRA owner would have reached age 70 1/2. If the IRA owner is younger than the spouse is, this could be an attractive option.

Despite these advantages and flexibilities, other beneficiary elections may make more sense.

Marital Deduction Trust

The use of a trust has many advantages such as the ability to “customize” the distribution of trust assets among beneficiaries, tax advantages and the ability to sprinkle income.

One main advantage of naming a marital trust as the beneficiary of your IRA is to include a QTIP provision (Qualified Terminal Interest Property). This allows the IRA owner to control where the property passes upon the death of the spouse. The most obvious use of a QTIP election is to make sure the children or a person are not disinherited due to the spouse’s own subsequent beneficiary election or a second marriage.

Credit Shelter Bypass Trust

These trusts take advantage of the unified credit the law provides each person. In simple terms, a credit shelter bypass trust has two parts, Part A and Part B. It receives all the estate assets. The spouse typically receives income from both parts. However, at the death of the spouse, their part flows directly to (generally) the children, thus removing it from double taxation. Today, proper planning and the use of a credit bypass trust can move $4,000,000 to the children free of tax.

RMDs from the IRA are still required and based on the life expectancy of the oldest beneficiary of the trust (probably the spouse). The tax advantages of the Credit Shelter trust conflict with the ability to stretch the RMDs out for the long possible time.

Dynasty Planning

Here, the goal is to provide for as many generations of beneficiaries as possible, as opposed to planning solely for the spouse. Again, RMDs are still required. The name of the game is to spread the payouts over the longest period possible by using the youngest beneficiaries. The advantage is the IRA account continues to grow at interest. Under the right circumstances, a $100,000 IRA could pay out over 20 million dollars.

Traditionally, a dynasty trust is used. While “the rule against perpetuities” is not in effect in all states, generally a person can spread the payout over several generations. The maximum would be the life of anyone alive at the death of the creator of the trust, plus 21 years. However, as we have seen, for RMD purposes, the life expectancy of the oldest trust beneficiary is required when a trust is the beneficiary of an IRA.

One way to get around this is to establish a dynasty trust for each beneficiary. Alternatively, to keep it simple, just name each beneficiary separately (i.e. children, grandchildren) and forget about the trust.

While naming the spouse as the only beneficiary of an IRA has its advantages, do not just blindly make this election. The size of your estate, the situation of your beneficiaries and your goals are some of the factors that may require another choice. This is the time to sit down with your financial planner and an estate planning attorney and review all the options and their consequences.

Robert D. Cavanaugh, CLU is a 36-year financial and estate planning veteran and author of the free newsletter, “The Estate Preservation Advisor”.

—————————————————————————————————————————————————————————————————————

We hope you found this article about “When Not to Name Your Spouse the Beneficiary of Your IRA” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Introducing the “Total Return” Trust

Introducing the “Total Return” Trust The fundamental purpose of most trusts is to create a plan of financial protection for more than one beneficiary, often beneficiaries in different generations. “All the trust income to my surviving spouse, with the balance to be divided among our children at her death” might be used in a marital…

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

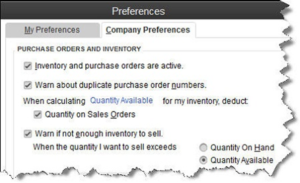

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…