Exciting American Dreams Show News, The First Book!

I have some exciting American Dreams Show news.

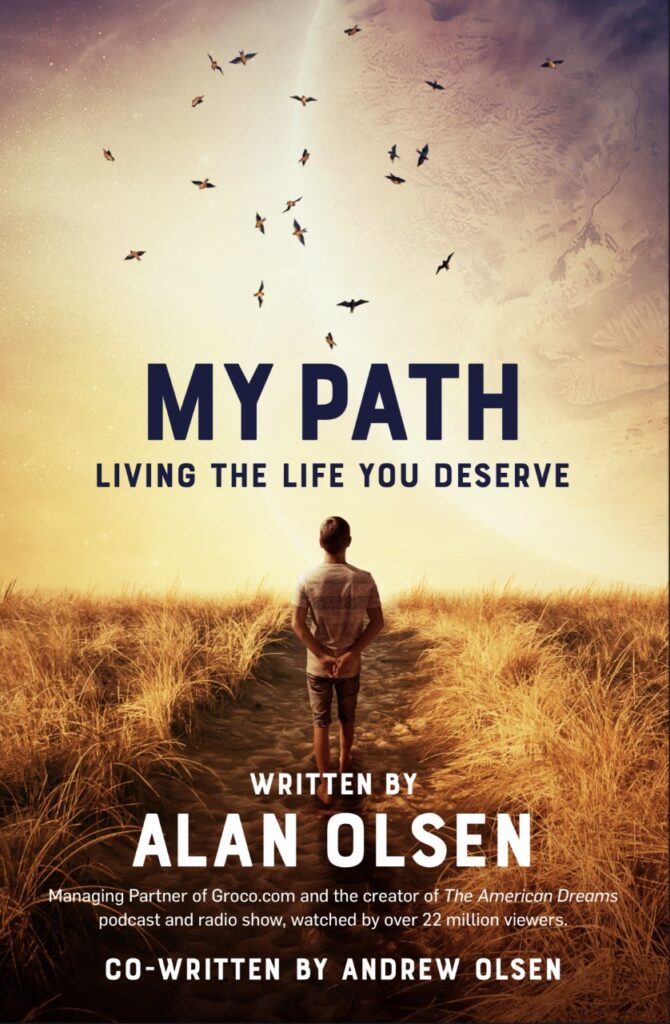

The host, Alan Olsen has written the first book based on the AD interviews! Other books have cited one or more of the interviews, but this one goes into far more details. Below is a letter from author himself describing the book…

From Alan…

Dear Friend,

I am excited to announce the publication of my first book, “My Path: Living the Life You Deserve.” This book is the culmination of the life lessons that I’ve learned that have gotten me to where I am today.

As many of you know, the past ten years of my life have been filled with getting to know entrepreneurs, philanthropists, artists, celebrities, and investors through my radio show, American Dreams. Sitting down weekly with individuals that have shaped the fabric of American society has been the highlight of my week for over a decade.

In my book I share some of the wisdoms and teachings that I’ve learned from my guests on American Dreams, and how you can apply these wisdoms to better your own life.

Early on in my career I saw that I was not living up to my full potential. I worked 60-hour weeks and commuted two hours a day. I barely knew my children, spent little time with my wife, nor did I have a life outside of work. That all changed when I went back and determined my life’s foundation and priorities.

As a result, I’ve been far more successful in my career, have seven children and twenty grandchildren, all of which I have a wonderful relationship with. I now spend my days fishing in the far reaches of the world, traveling to tropical destinations, relaxing at home, and spending quality time with my family.

All of this would not have been possible had it not been for the principals outlined within my book that I applied into my own life. The path was not always easy, but the direction I needed to take was always clear.

I’d like to extend a personal invitation to you to read my book and give me your thoughts when you are finished.

I hope that by reading “My Path” you’ll gain the wisdom needed to transform your life into one that you deserve to live.

Pre-Order here: https://mypaths.com/product/my-path/

Sincerely,

Alan Olsen

We hope you found this article about “Exciting American Dreams Show News, A Book!?” helpful.

If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

7 Choices in Real Estate Foreclosure

Below are 7 choices in real estate foreclosure you will hopefully never actually need. Everyone’s situation is different. This list is merely a compilation of suggestions. Only a guide to help you get started. It should not be a substitute to talking with your CPA/attorney about your individual situation. Other resources may include the internet…

Top Ten Real Estate Tax Breaks

Here’s a look at the Top 10 Real Estate Tax Breaks for the homeowner/investor. Real Estate Tips 1-3 1. Mortgage Loan Interest: Deductions reduce your taxable income against which your taxes due are calculated.2. Home Improvement Loan Interest: You can deduct all the interest on a home improvement loan provided the work is a “capital improvement”…

GROCO’s Mission Statement

GROCO’s Mission Statement About GROCO At Greenstein, Rogoff, Olsen & Co., we strive to deliver the best service to our clients. We are successful because we stay true to our vision, work hard toward our mission, and employ a series of core values. Our Vision is to be the most trusted advisors in the Bay Area serving…

Choosing a Real Estate Investment Market

Choosing a Real Estate Investment Market OK, everyone’s heard the old saying that “Location, Location, Location” is the most important factor when buying real estate right? But what does that really mean? What about a location should you know before buying a property for long term rental? Buying because the property’s in your own home…